Bank Transaction Fraud Detection 01

Problem Statement

With the rapid growth of digital banking, fraudulent transactions have become a significant concern for financial institutions. The challenge is to build a robust system to detect and prevent fraudulent transactions in real-time while maintaining customer convenience and privacy.

The dataset provided contains detailed information about bank transactions, including customer demographics, transaction metadata, merchant categories, device types, transaction locations, and other relevant attributes. Key fields like transaction descriptions, device usage, and merchant categories provide vital insights for identifying anomalous activities. The "Is_Fraud" label offers a foundation for supervised learning techniques to differentiate between genuine and fraudulent transactions.

The objective of this problem is to analyze transaction patterns and develop predictive models that can accurately classify transactions as fraudulent or legitimate. This task involves exploring feature correlations, detecting unusual transaction behavior, and leveraging machine learning algorithms to create a scalable and efficient fraud detection system.

A successful solution will not only detect fraudulent activities but also minimize false positives, ensuring genuine transactions are not unnecessarily flagged. Insights derived from this analysis can help strengthen security measures, optimize fraud prevention strategies, and enhance the overall banking experience for customers.

Objectives for Bank Transaction Fraud Detection

- Fraud Detection:

- Develop a predictive model to classify bank transactions as fraudulent or legitimate using historical transaction data.

- Anomaly Detection:

- Identify unusual patterns or behaviors in customer transactions that may indicate potential fraud.

- Feature Analysis:

- Explore key features such as merchant categories, transaction devices, transaction locations, and account types to understand their impact on fraud detection.

- Model Performance Optimization:

- Ensure the fraud detection system achieves high accuracy, precision, and recall while minimizing false positives and false negatives.

- Real-Time Fraud Prevention:

- Create a scalable solution that can potentially be adapted for real-time fraud detection in production environments.

- Customer Behavior Insights:

- Analyze legitimate transaction behaviors to gain insights into customer banking patterns and preferences.

- Device and Location Security:

- Understand the correlation between transaction device types, locations, and fraudulent activities.

- Security Enhancements:

- Provide actionable recommendations to the bank for improving fraud prevention strategies and enhancing digital transaction security.

Technologies Used

- Python

- Scikit-learn

- Pandas

- NumPy

Jupyter Notebook

Stage 1 - Importing Libraries

# Import necessary libraries

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from imblearn.over_sampling import SMOTE

from sklearn.decomposition import PCA

from sklearn.utils.class_weight import compute_class_weight

from sklearn.neighbors import KNeighborsClassifier

from sklearn.naive_bayes import GaussianNB

from sklearn.model_selection import train_test_split, cross_val_score, GridSearchCV

from sklearn.preprocessing import StandardScaler, LabelEncoder

from sklearn.metrics import classification_report, confusion_matrix, roc_auc_score

from sklearn.linear_model import LogisticRegression

# from sklearn.linear_model import LinearDiscriminantAnalysis as LDA, RidgeClassifier

from sklearn.tree import DecisionTreeClassifier

from sklearn.ensemble import RandomForestClassifier, GradientBoostingClassifier, AdaBoostClassifier, BaggingClassifier

from sklearn.svm import SVC, LinearSVC

from sklearn.metrics import accuracy_score, classification_report, confusion_matrix

from sklearn import metrics

import xgboost as xgb

import lightgbm as lgb

import catboost as cb

import warnings

# Suppress all warnings

warnings.filterwarnings("ignore")

# Load the dataset

df = pd.read_csv('Bank_Transaction_Fraud_Detection.csv')

df.head()

Output

Customer_ID Customer_Name Gender Age State City Bank_Branch Account_Type Transaction_ID Transaction_Date ... Merchant_Category Account_Balance Transaction_Device Transaction_Location Device_Type Is_Fraud Transaction_Currency Customer_Contact Transaction_Description Customer_Email

0 d5f6ec07-d69e-4f47-b9b4-7c58ff17c19e Osha Tella Male 60 Kerala Thiruvananthapuram Thiruvananthapuram Branch Savings 4fa3208f-9e23-42dc-b330-844829d0c12c 23-01-2025 ... Restaurant 74557.27 Voice Assistant Thiruvananthapuram, Kerala POS 0 INR +9198579XXXXXX Bitcoin transaction oshaXXXXX@XXXXX.com

1 7c14ad51-781a-4db9-b7bd-67439c175262 Hredhaan Khosla Female 51 Maharashtra Nashik Nashik Branch Business c9de0c06-2c4c-40a9-97ed-3c7b8f97c79c 11-01-2025 ... Restaurant 74622.66 POS Mobile Device Nashik, Maharashtra Desktop 0 INR +9191074XXXXXX Grocery delivery hredhaanXXXX@XXXXXX.com

2 3a73a0e5-d4da-45aa-85f3-528413900a35 Ekani Nazareth Male 20 Bihar Bhagalpur Bhagalpur Branch Savings e41c55f9-c016-4ff3-872b-cae72467c75c 25-01-2025 ... Groceries 66817.99 ATM Bhagalpur, Bihar Desktop 0 INR +9197745XXXXXX Mutual fund investment ekaniXXX@XXXXXX.com

3 7902f4ef-9050-4a79-857d-9c2ea3181940 Yamini Ramachandran Female 57 Tamil Nadu Chennai Chennai Branch Business 7f7ee11b-ff2c-45a3-802a-49bc47c02ecb 19-01-2025 ... Entertainment 58177.08 POS Mobile App Chennai, Tamil Nadu Mobile 0 INR +9195889XXXXXX Food delivery yaminiXXXXX@XXXXXXX.com

4 3a4bba70-d9a9-4c5f-8b92-1735fd8c19e9 Kritika Rege Female 43 Punjab Amritsar Amritsar Branch Savings f8e6ac6f-81a1-4985-bf12-f60967d852ef 30-01-2025 ... Entertainment 16108.56 Virtual Card Amritsar, Punjab Mobile 0 INR +9195316XXXXXX Debt repayment kritikaXXXX@XXXXXX.com

df.info()

Output

df.shape

Output

(200000, 24)

df.duplicated().sum()

Output

0

Stage 2 - Data Preprocessing

# Checking for missing values

print("Missing NULL values in the dataset:")

print(df.isnull().sum())

print("-"*80)

print("Missing N/A values in the dataset:")

print(df.isna().sum())

Output

.sum().png)

.sum().png)

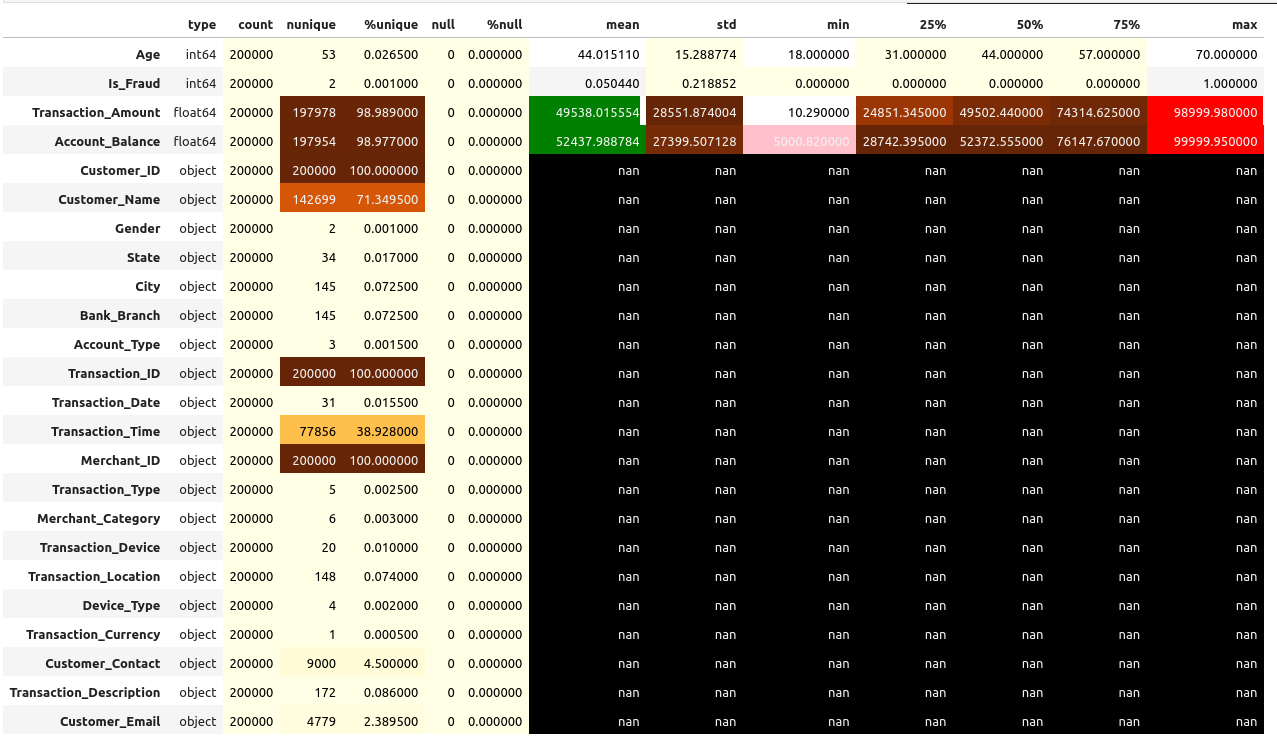

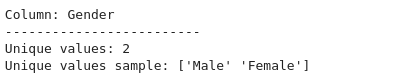

desc = pd.DataFrame(index = list(df))

desc['type'] = df.dtypes

desc['count'] = df.count()

desc['nunique'] = df.nunique()

desc['%unique'] = desc['nunique'] /len(df) * 100

desc['null'] = df.isnull().sum()

desc['%null'] = desc['null'] / len(df) * 100

desc = pd.concat([desc,df.describe().T.drop('count',axis=1)],axis=1)

desc.sort_values(by=['type','null']).style.background_gradient(cmap='YlOrBr')\

.bar(subset=['mean'],color='green')\

.bar(subset=['max'],color='red')\

.bar(subset=['min'], color='pink')

Output

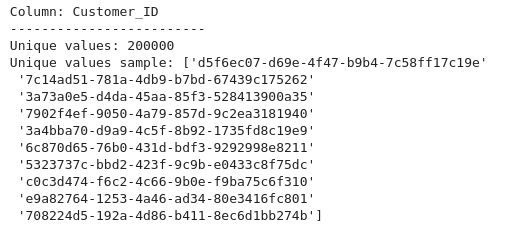

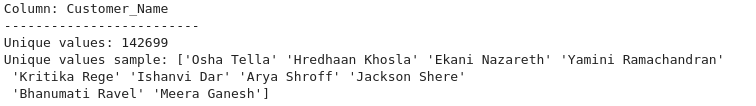

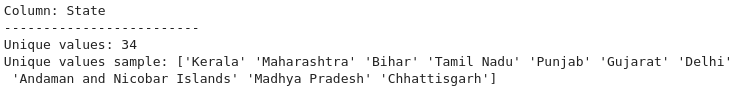

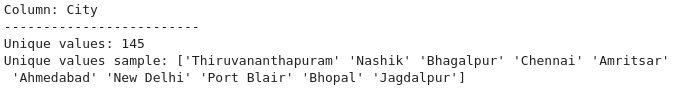

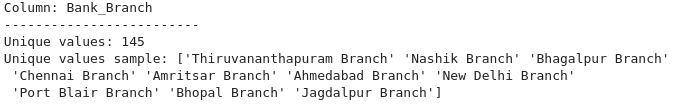

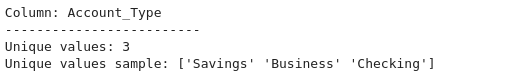

# Get a list of categorical columns in the dataframe

categorical_columns = df.select_dtypes(include=['object']).columns

# Check the unique values and their counts for each categorical column

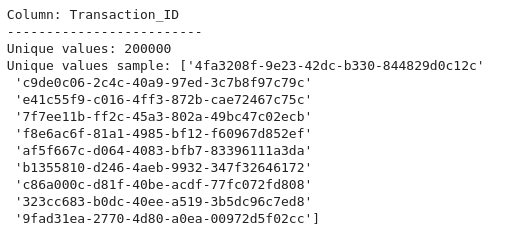

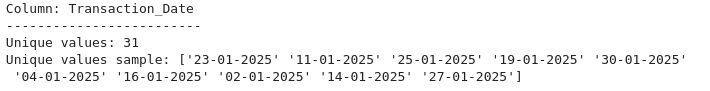

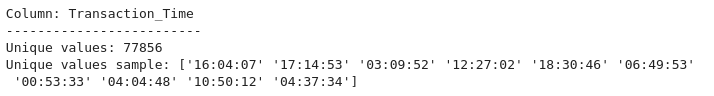

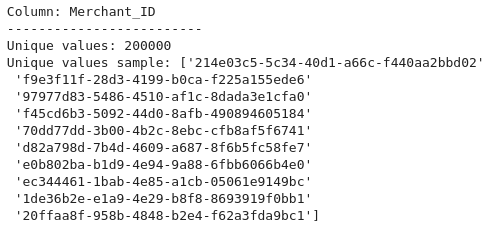

for col in categorical_columns:

print(f"Column: {col}")

print("-" * 25)

print(f"Unique values: {df[col].nunique()}")

print(f"Unique values sample: {df[col].unique()[:10]}") # Display a sample of unique values

print("-" * 50)

Output

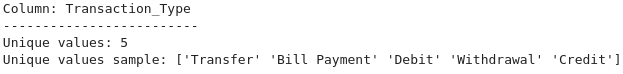

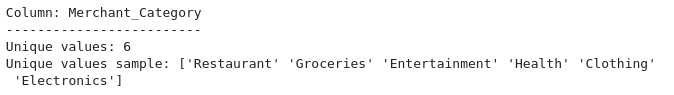

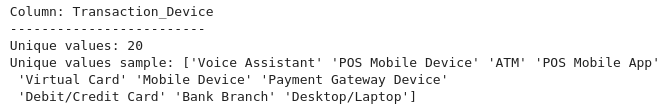

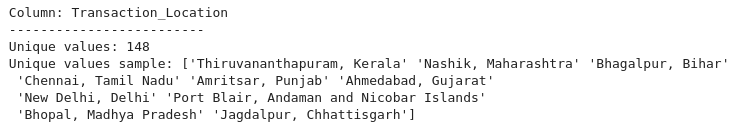

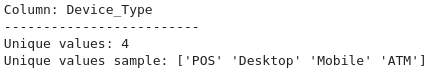

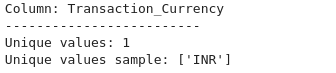

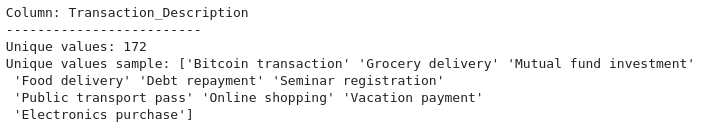

Check the unique values and their counts for each categorical column

# If a column has only one unique value, it won't be useful for prediction.

single_value_columns = [col for col in df.columns if df[col].nunique() == 1]

print("Columns with only one unique value:", single_value_columns)

# Dropping columns with one unique value

df = df.drop(columns=single_value_columns)

Output

Columns with only one unique value: ['Transaction_Currency']

# Checking columns after dropping one unique columns

df.columns

Output

Index(['Customer_ID', 'Customer_Name', 'Gender', 'Age', 'State', 'City',

'Bank_Branch', 'Account_Type', 'Transaction_ID', 'Transaction_Date',

'Transaction_Time', 'Transaction_Amount', 'Merchant_ID',

'Transaction_Type', 'Merchant_Category', 'Account_Balance',

'Transaction_Device', 'Transaction_Location', 'Device_Type', 'Is_Fraud',

'Customer_Contact', 'Transaction_Description', 'Customer_Email'],

dtype='object')

# Drop the columns which are not useful for the model evaluation

df = df.drop(columns=['Customer_Contact', 'Customer_Email', 'Customer_Name', 'Customer_ID', 'Transaction_ID', 'Merchant_ID'])

print(df.shape)

Output

(200000, 17)

# Checking columns after dropping not useful columns

df.columns

Output

Index(['Gender', 'Age', 'State', 'City', 'Bank_Branch', 'Account_Type',

'Transaction_Date', 'Transaction_Time', 'Transaction_Amount',

'Transaction_Type', 'Merchant_Category', 'Account_Balance',

'Transaction_Device', 'Transaction_Location', 'Device_Type', 'Is_Fraud',

'Transaction_Description'],

dtype='object')

Stage 3 - Exploratory Data Analysis (EDA)

EDA for Numerical Columns

# For numerical columns, we'll fill missing values with the median of each column

numerical_columns = df.select_dtypes(include=['float64', 'int64']).columns

for col in numerical_columns:

df[col] = df[col].fillna(df[col].median())

print(numerical_columns)

Output

Index(['Age', 'Transaction_Amount', 'Account_Balance', 'Is_Fraud'], dtype='object')

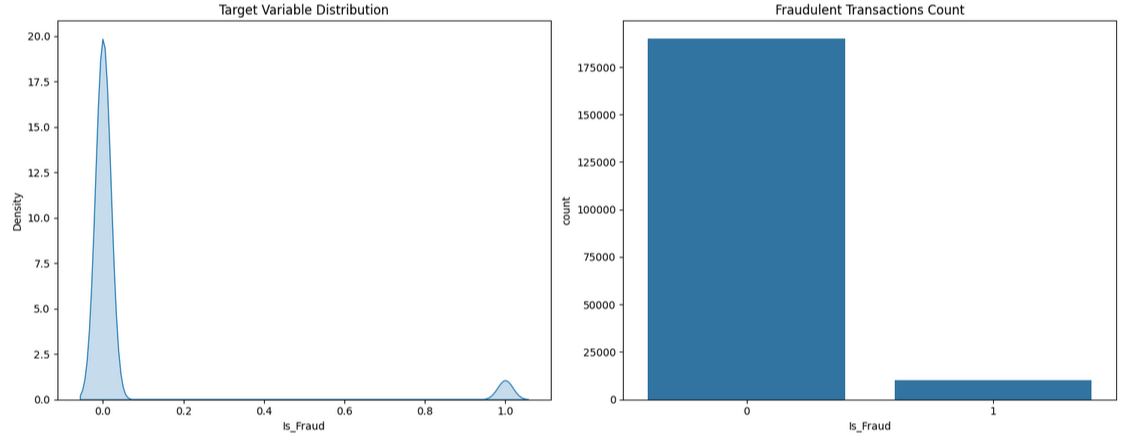

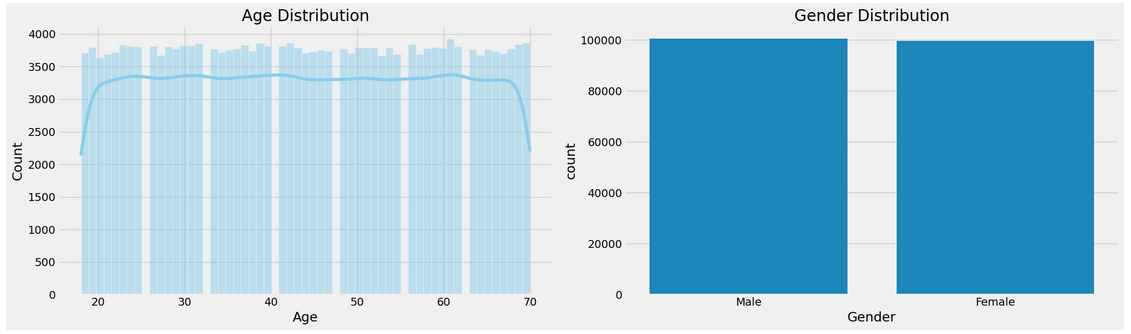

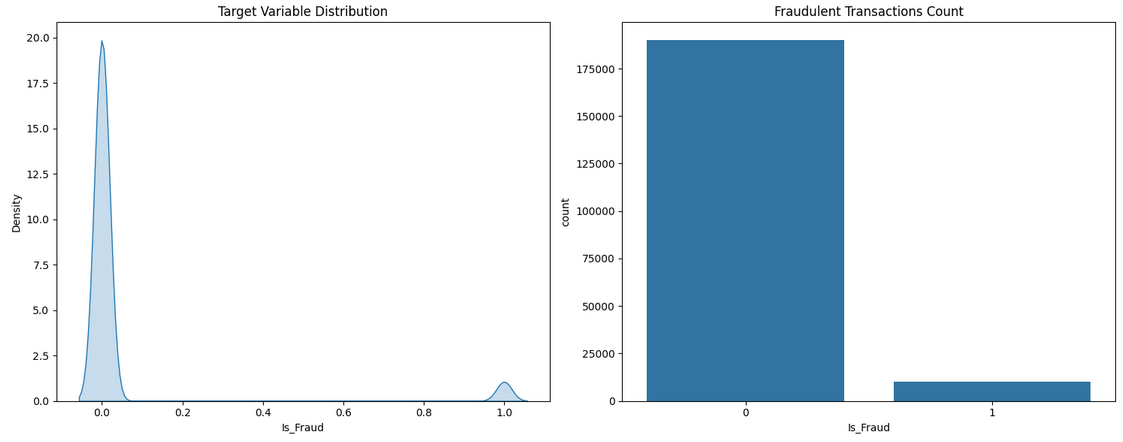

# Create a figure with 2 subplots in a horizontal row

fig, axes = plt.subplots(1, 2, figsize=(15, 6)) # 1 row, 2 columns

# KDE plot for the 'Is_Fraud' column (on the first subplot)

sns.kdeplot(df["Is_Fraud"], fill=True, ax=axes[0])

axes[0].set_title('Target Variable Distribution')

# Count plot for the 'Is_Fraud' column (on the second subplot)

sns.countplot(x='Is_Fraud', data=df, ax=axes[1])

axes[1].set_title('Fraudulent Transactions Count')

# Adjust layout to prevent overlap

plt.tight_layout()

# Show the plot

plt.show()

Output

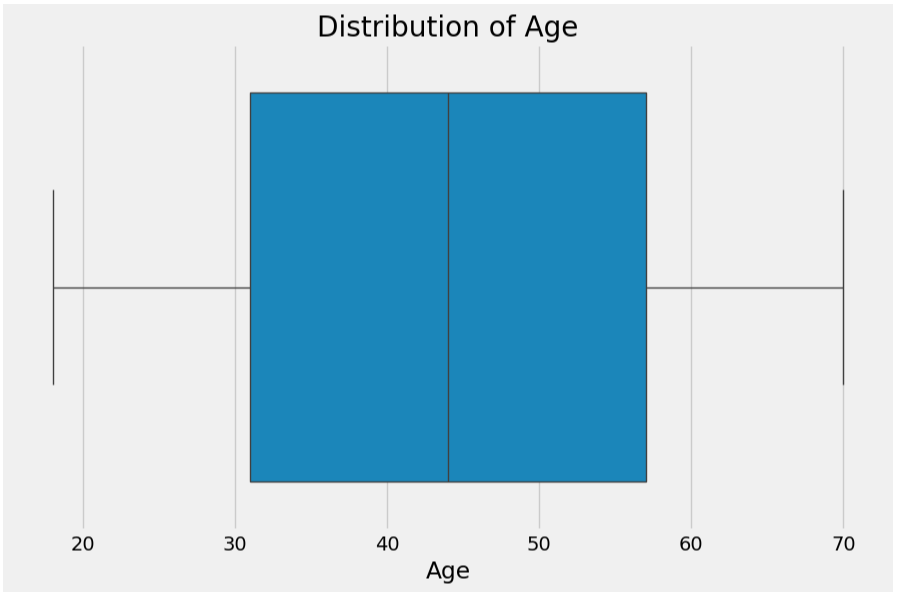

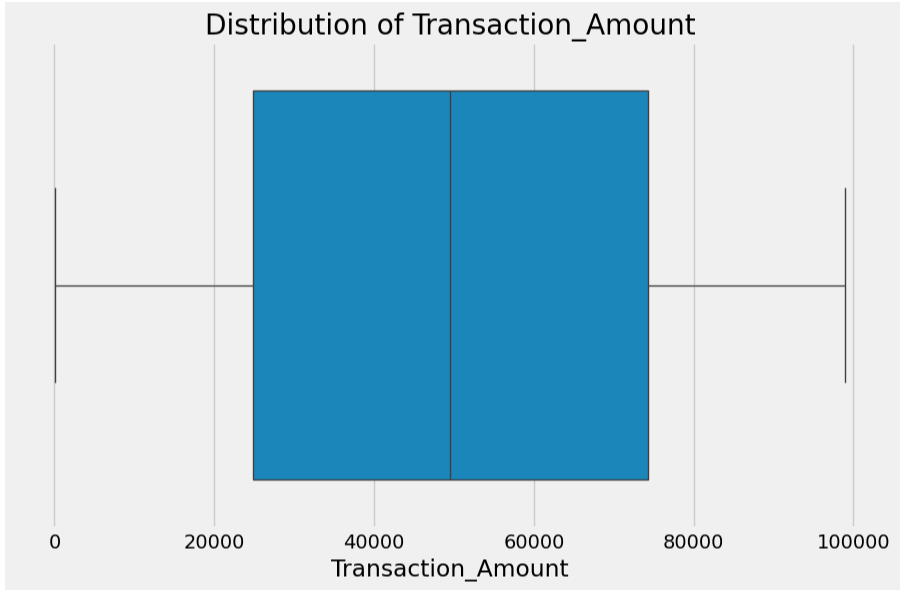

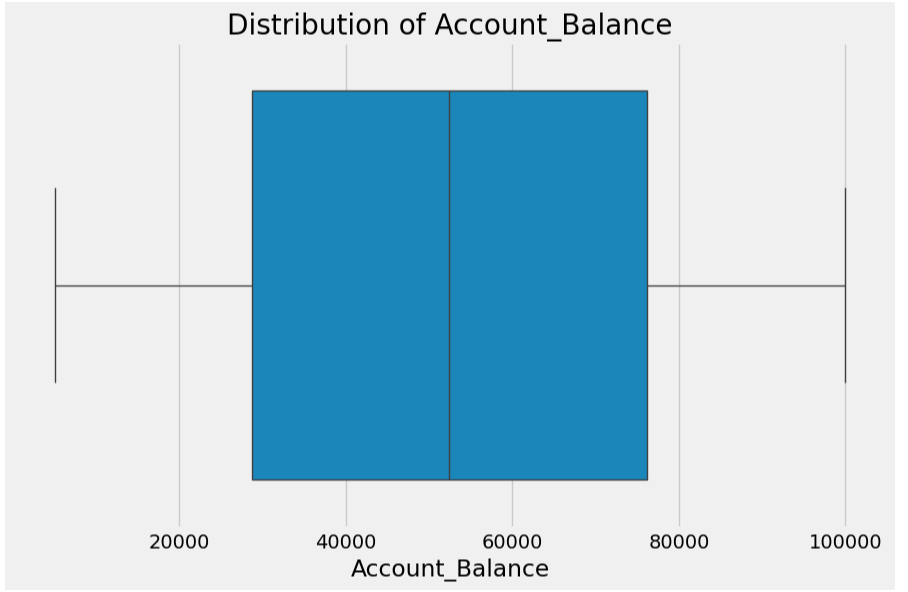

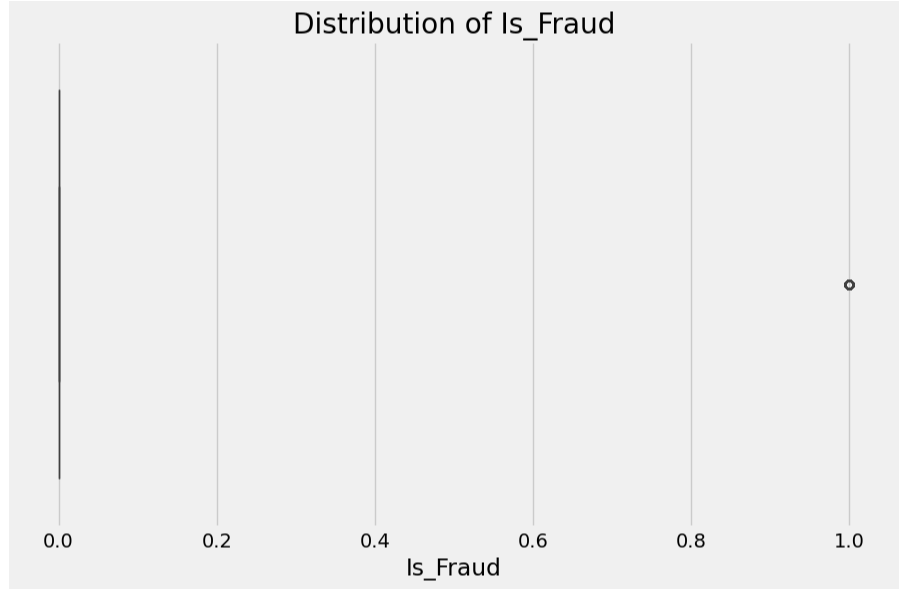

# Loop through each numerical column in your DataFrame

for col in numerical_columns:

plt.style.use("fivethirtyeight")

plt.figure(figsize=(10, 6))

# Create the boxplot

sns.boxplot(x=df[col])

plt.title(f'Distribution of {col}')

plt.xlabel(col)

# Show the plot

plt.show()

Output

EDA for Categorical Columns

Index(['Customer_ID', 'Customer_Name', 'Gender', 'State', 'City',

'Bank_Branch', 'Account_Type', 'Transaction_ID', 'Transaction_Date',

'Transaction_Time', 'Merchant_ID', 'Transaction_Type',

'Merchant_Category', 'Transaction_Device', 'Transaction_Location',

'Device_Type', 'Transaction_Currency', 'Customer_Contact',

'Transaction_Description', 'Customer_Email'],

dtype='object')

Output

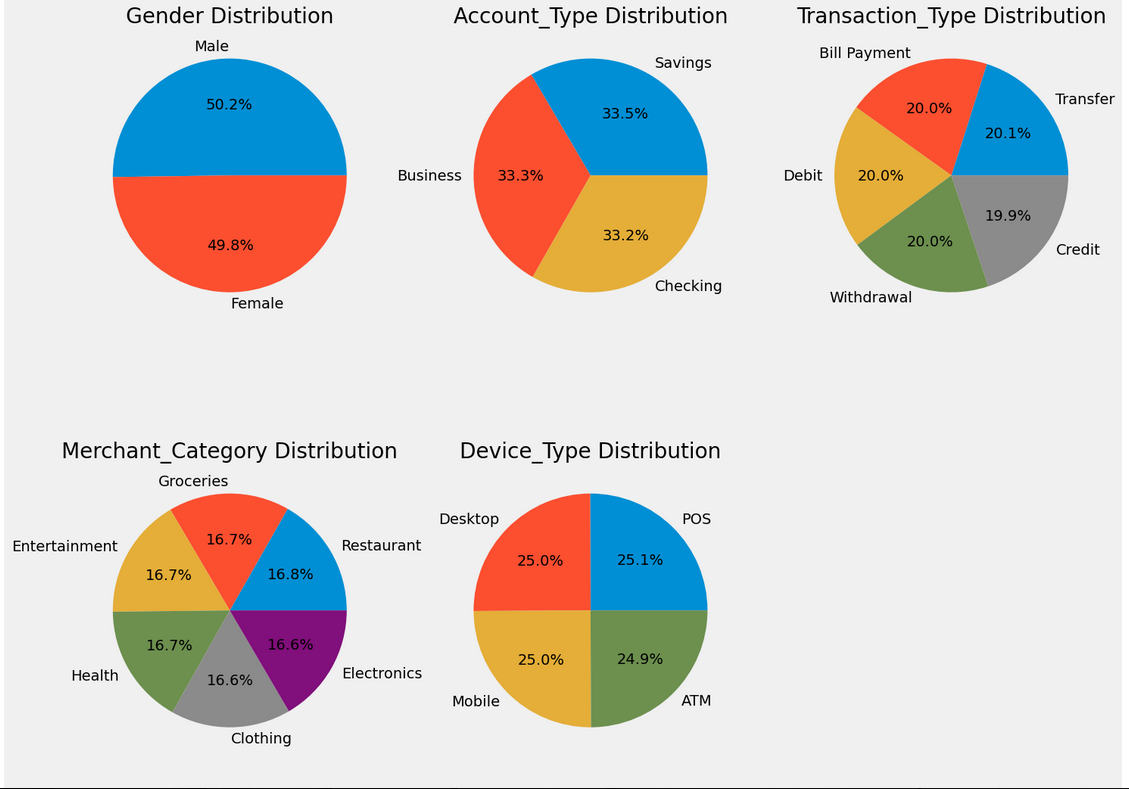

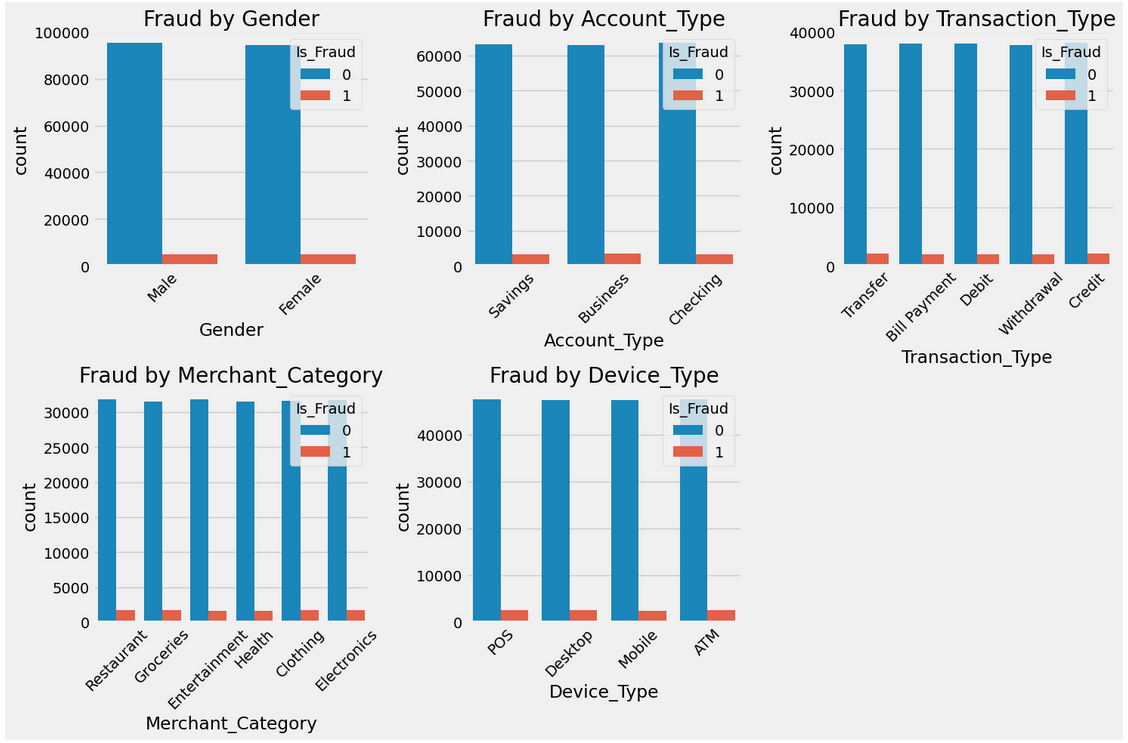

# Calculate the number of rows needed based on the number of charts

num_cols = 3 # Number of charts per row

# num_rows = (len(categorical_columns) + num_cols - 1) // num_cols # Calculate rows required for all charts

num_rows = 2 # Number of rows

fig, axes = plt.subplots(num_rows, num_cols, figsize=(15, num_rows * 6)) # Adjust figure size for more rows

# Flatten the axes array for easier iteration

axes = axes.flatten()

ax_index = 0

for col in categorical_columns:

unique_values = df[col].nunique()

if unique_values < 10: # Only plot if unique values are less than 10

# Plot on the respective subplot

ax = axes[ax_index]

ax.pie(df[col].value_counts(), labels=df[col].unique(), autopct='%1.1f%%')

ax.set_title(f'{col} Distribution')

# Move to the next subplot

ax_index += 1

# Hide any unused subplots (in case there are fewer than `num_rows * num_cols` charts)

for i in range(ax_index, len(axes)):

axes[i].axis('off')

# Adjust layout

plt.tight_layout()

plt.show()

Output

import matplotlib.pyplot as plt

import seaborn as sns

# Filter categorical columns with less than 20 unique values

categorical_cols = df.select_dtypes(include=['object']).columns

categorical_cols = [col for col in categorical_cols if df[col].nunique() < 20]

# Set the number of charts per row and rows

num_cols = 3 # Number of charts per row

num_rows = 2 # Number of rows

# Calculate the total number of subplots needed

total_plots = len(categorical_cols)

# Create a figure with the appropriate number of rows and columns

plt.figure(figsize=(15, 5 * num_rows))

# Plot the count plots for the filtered categorical columns

for i, col in enumerate(categorical_cols):

plt.subplot(num_rows, num_cols, i + 1)

sns.countplot(data=df, x=col, hue='Is_Fraud')

plt.title(f'Fraud by {col}')

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

# Calculate churn rate by categories

print("\Fraud Rate by Categories:")

for col in categorical_cols:

print(f"\n{col} Analysis:")

print(df.groupby(col)['Is_Fraud'].mean().round(3) * 100)

Output

\Fraud Rate by Categories:

Gender Analysis:

Gender

Female 5.0

Male 5.1

Name: Is_Fraud, dtype: float64

Account_Type Analysis:

Account_Type

Business 5.2

Checking 4.9

Savings 5.0

Name: Is_Fraud, dtype: float64

Transaction_Type Analysis:

Transaction_Type

Bill Payment 4.9

Credit 5.1

Debit 5.1

Transfer 5.2

Withdrawal 4.9

Name: Is_Fraud, dtype: float64

Merchant_Category Analysis:

Merchant_Category

Clothing 5.2

Electronics 5.0

Entertainment 4.8

Groceries 5.2

Health 5.0

Restaurant 5.0

Name: Is_Fraud, dtype: float64

Device_Type Analysis:

Device_Type

ATM 5.0

Desktop 5.1

Mobile 5.0

POS 5.1

Name: Is_Fraud, dtype: float64

Stage 4 - Convert Date Time Columns to Numerical Columns

Convert 'Transaction_Date' and 'Transaction_Time' to datetime

df['Transaction_Date'] = pd.to_datetime(df['Transaction_Date'], format='%d-%m-%Y')

df['Transaction_Time'] = pd.to_datetime(df['Transaction_Time'], format='%H:%M:%S')

# Extract new features from 'Transaction_Date' and 'Transaction_Time'

df['Transaction_Day'] = df['Transaction_Date'].dt.day

df['Transaction_Month'] = df['Transaction_Date'].dt.month

df['Transaction_Year'] = df['Transaction_Date'].dt.year

df['Transaction_Hour'] = df['Transaction_Time'].dt.hour

df['Transaction_Minute'] = df['Transaction_Time'].dt.minute

df['Transaction_Second'] = df['Transaction_Time'].dt.second

# Drop 'Transaction_Date' and 'Transaction_Time' columns after feature extraction

df = df.drop(columns=['Transaction_Date', 'Transaction_Time'])

# If a column has only one unique value, it won't be useful for prediction.

single_value_cols = [col for col in df.columns if df[col].nunique() == 1]

print("Columns with only one unique value:", single_value_columns)

# Dropping columns with one unique value

df = df.drop(columns=single_value_cols)

Output

Columns with only one unique value: ['Transaction_Currency']

# For numerical columns, updating after conversion

numerical_columns = df.select_dtypes(include=['float64', 'int64']).columns

print("Numerical Columns ::", numerical_columns)

print("-"*50)

# For categorical columns, updating after conversion

categorical_columns = df.select_dtypes(include=['object']).columns

print("Categorical Columns ::", categorical_columns)

Output

Numerical Columns :: Index(['Age', 'Transaction_Amount', 'Account_Balance', 'Is_Fraud'], dtype='object')

--------------------------------------------------

Categorical Columns :: Index(['Gender', 'State', 'City', 'Bank_Branch', 'Account_Type',

'Transaction_Type', 'Merchant_Category', 'Transaction_Device',

'Transaction_Location', 'Device_Type', 'Transaction_Description'],

dtype='object')

df.head()

Output

Gender Age State City Bank_Branch Account_Type Transaction_Amount Transaction_Type Merchant_Category Account_Balance Transaction_Device Transaction_Location Device_Type Is_Fraud Transaction_Description Transaction_Day Transaction_Hour Transaction_Minute Transaction_Second

0 Male 60 Kerala Thiruvananthapuram Thiruvananthapuram Branch Savings 32415.45 Transfer Restaurant 74557.27 Voice Assistant Thiruvananthapuram, Kerala POS 0 Bitcoin transaction 23 16 4 7

1 Female 51 Maharashtra Nashik Nashik Branch Business 43622.60 Bill Payment Restaurant 74622.66 POS Mobile Device Nashik, Maharashtra Desktop 0 Grocery delivery 11 17 14 53

2 Male 20 Bihar Bhagalpur Bhagalpur Branch Savings 63062.56 Bill Payment Groceries 66817.99 ATM Bhagalpur, Bihar Desktop 0 Mutual fund investment 25 3 9 52

3 Female 57 Tamil Nadu Chennai Chennai Branch Business 14000.72 Debit Entertainment 58177.08 POS Mobile App Chennai, Tamil Nadu Mobile 0 Food delivery 19 12 27 2

4 Female 43 Punjab Amritsar Amritsar Branch Savings 18335.16 Transfer Entertainment 16108.56 Virtual Card Amritsar, Punjab Mobile 0 Debt repayment 30 18 30 46

Stage 5 - Encode Categorical Features

# Initializing the LabelEncoder

label_encoder = LabelEncoder()

for col in categorical_columns:

df[col] = label_encoder.fit_transform(df[col])

df.head()

Output

Customer_ID Customer_Name Gender Age State City Bank_Branch Account_Type Transaction_ID Transaction_Date ... Merchant_Category Account_Balance Transaction_Device Transaction_Location Device_Type Is_Fraud Transaction_Currency Customer_Contact Transaction_Description Customer_Email

0 d5f6ec07-d69e-4f47-b9b4-7c58ff17c19e Osha Tella Male 60 Kerala Thiruvananthapuram Thiruvananthapuram Branch Savings 4fa3208f-9e23-42dc-b330-844829d0c12c 23-01-2025 ... Restaurant 74557.27 Voice Assistant Thiruvananthapuram, Kerala POS 0 INR +9198579XXXXXX Bitcoin transaction oshaXXXXX@XXXXX.com

1 7c14ad51-781a-4db9-b7bd-67439c175262 Hredhaan Khosla Female 51 Maharashtra Nashik Nashik Branch Business c9de0c06-2c4c-40a9-97ed-3c7b8f97c79c 11-01-2025 ... Restaurant 74622.66 POS Mobile Device Nashik, Maharashtra Desktop 0 INR +9191074XXXXXX Grocery delivery hredhaanXXXX@XXXXXX.com

2 3a73a0e5-d4da-45aa-85f3-528413900a35 Ekani Nazareth Male 20 Bihar Bhagalpur Bhagalpur Branch Savings e41c55f9-c016-4ff3-872b-cae72467c75c 25-01-2025 ... Groceries 66817.99 ATM Bhagalpur, Bihar Desktop 0 INR +9197745XXXXXX Mutual fund investment ekaniXXX@XXXXXX.com

3 7902f4ef-9050-4a79-857d-9c2ea3181940 Yamini Ramachandran Female 57 Tamil Nadu Chennai Chennai Branch Business 7f7ee11b-ff2c-45a3-802a-49bc47c02ecb 19-01-2025 ... Entertainment 58177.08 POS Mobile App Chennai, Tamil Nadu Mobile 0 INR +9195889XXXXXX Food delivery yaminiXXXXX@XXXXXXX.com

4 3a4bba70-d9a9-4c5f-8b92-1735fd8c19e9 Kritika Rege Female 43 Punjab Amritsar Amritsar Branch Savings f8e6ac6f-81a1-4985-bf12-f60967d852ef 30-01-2025 ... Entertainment 16108.56 Virtual Card Amritsar, Punjab Mobile 0 INR +9195316XXXXXX Debt repayment kritikaXXXX@XXXXXX.com

5 rows × 24 columns

df.info()

Output

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 200000 entries, 0 to 199999

Data columns (total 19 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Gender 200000 non-null int64

1 Age 200000 non-null int64

2 State 200000 non-null int64

3 City 200000 non-null int64

4 Bank_Branch 200000 non-null int64

5 Account_Type 200000 non-null int64

6 Transaction_Amount 200000 non-null float64

7 Transaction_Type 200000 non-null int64

8 Merchant_Category 200000 non-null int64

9 Account_Balance 200000 non-null float64

10 Transaction_Device 200000 non-null int64

11 Transaction_Location 200000 non-null int64

12 Device_Type 200000 non-null int64

13 Is_Fraud 200000 non-null int64

14 Transaction_Description 200000 non-null int64

15 Transaction_Day 200000 non-null int32

16 Transaction_Hour 200000 non-null int32

17 Transaction_Minute 200000 non-null int32

18 Transaction_Second 200000 non-null int32

dtypes: float64(2), int32(4), int64(13)

memory usage: 25.9 MB

df.nunique()

Output

Gender 2

Age 53

State 34

City 145

Bank_Branch 145

Account_Type 3

Transaction_Amount 197978

Transaction_Type 5

Merchant_Category 6

Account_Balance 197954

Transaction_Device 20

Transaction_Location 148

Device_Type 4

Is_Fraud 2

Transaction_Description 172

Transaction_Day 31

Transaction_Hour 24

Transaction_Minute 60

Transaction_Second 60

dtype: int64

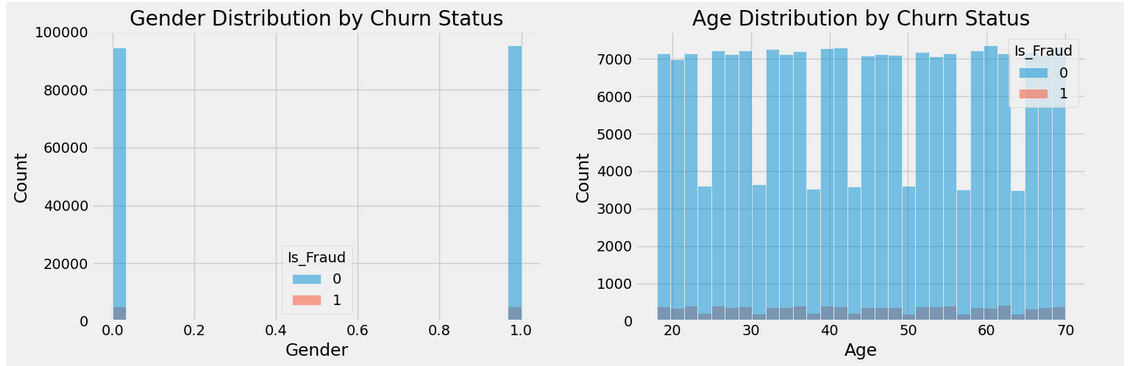

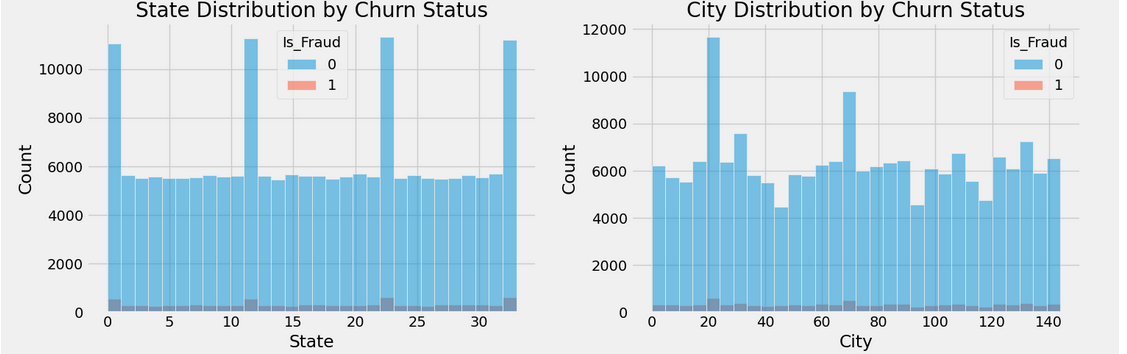

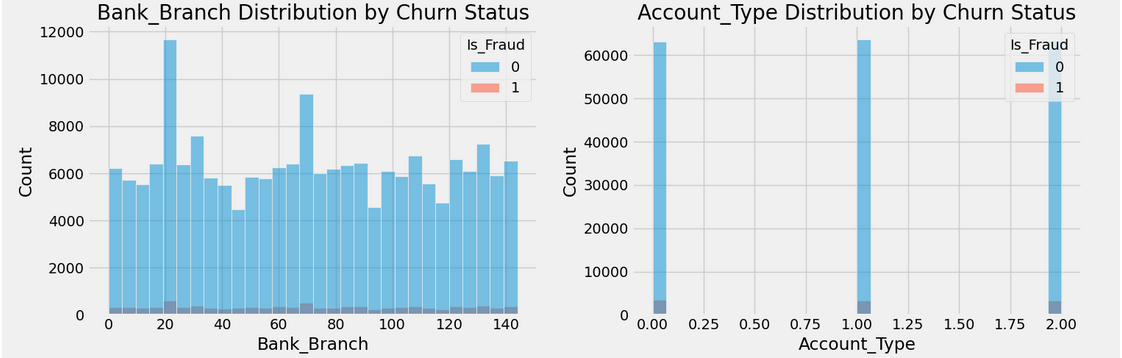

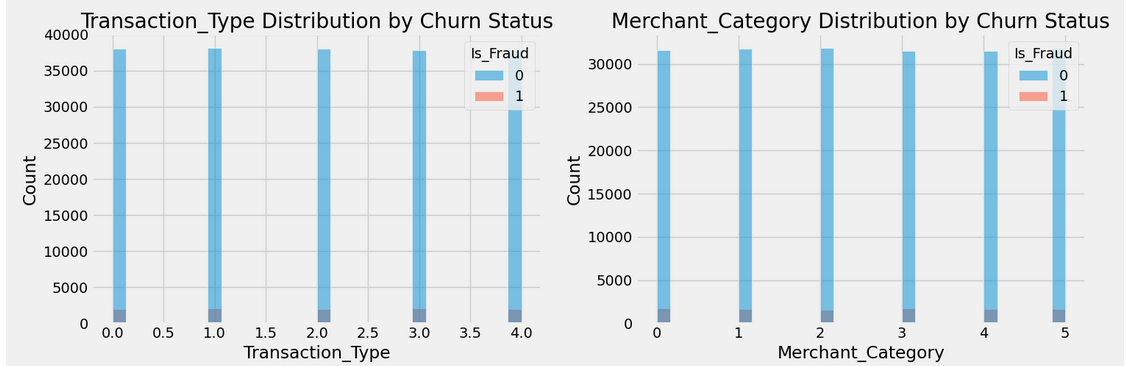

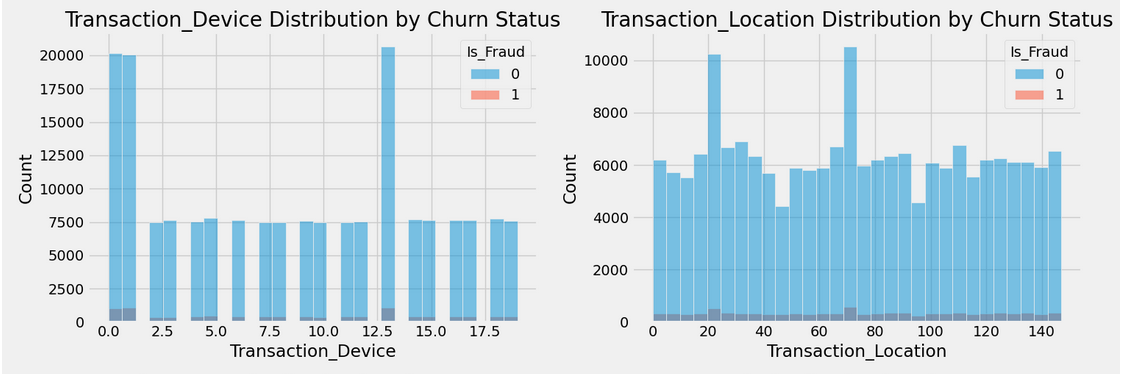

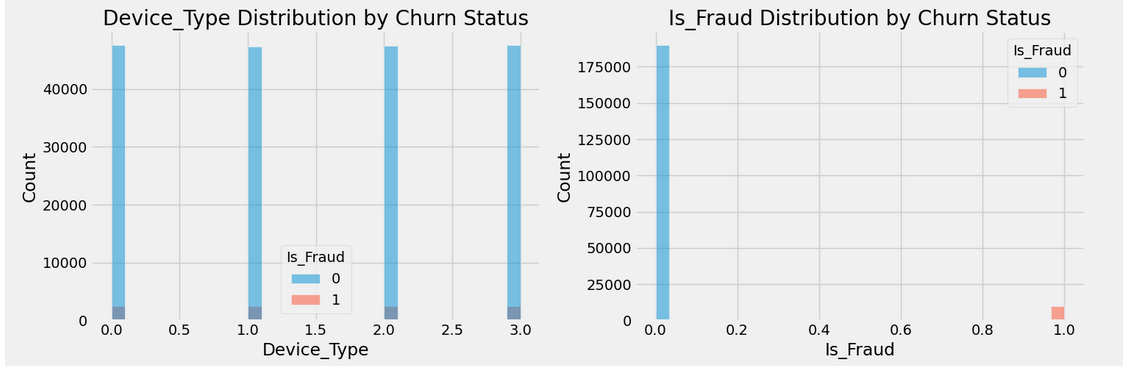

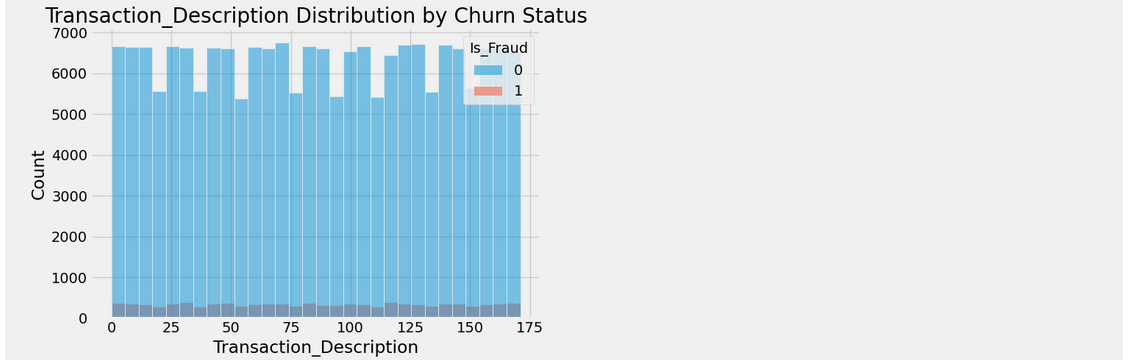

Stage 6 - EDA after Label Encoder

import matplotlib.pyplot as plt

import seaborn as sns

# Filter numerical columns with less than 20 unique values

numerical_features = df.select_dtypes(include=['float64', 'int64']).columns

numerical_features = [col for col in numerical_features if df[col].nunique() < 200]

# Set the number of charts per row

num_cols = 2 # Number of charts per row

# Calculate the number of rows needed based on the number of features

num_rows = (len(numerical_features) + num_cols - 1) // num_cols # This ensures enough rows are created

# Create a figure with the appropriate number of rows and columns

plt.figure(figsize=(15, 5 * num_rows))

# Plot the histograms for the filtered numerical columns

for i, feature in enumerate(numerical_features):

plt.subplot(num_rows, num_cols, i + 1)

sns.histplot(data=df, x=feature, hue='Is_Fraud', bins=30)

plt.title(f'{feature} Distribution by Churn Status')

plt.tight_layout()

plt.show()

Output

Stage 7 - Visualize Fraud Patterns and Distribution of Features

# Create a figure with 2 subplots in a horizontal row

fig, axes = plt.subplots(1, 2, figsize=(15, 6)) # 1 row, 2 columns

# KDE plot for the 'Is_Fraud' column (on the first subplot)

sns.kdeplot(df["Is_Fraud"], fill=True, ax=axes[0])

axes[0].set_title('Target Variable Distribution')

# Count plot for the 'Is_Fraud' column (on the second subplot)

sns.countplot(x='Is_Fraud', data=df, ax=axes[1])

axes[1].set_title('Fraudulent Transactions Count')

# Adjust layout to prevent overlap

plt.tight_layout()

# Show the plot

plt.show()

Output

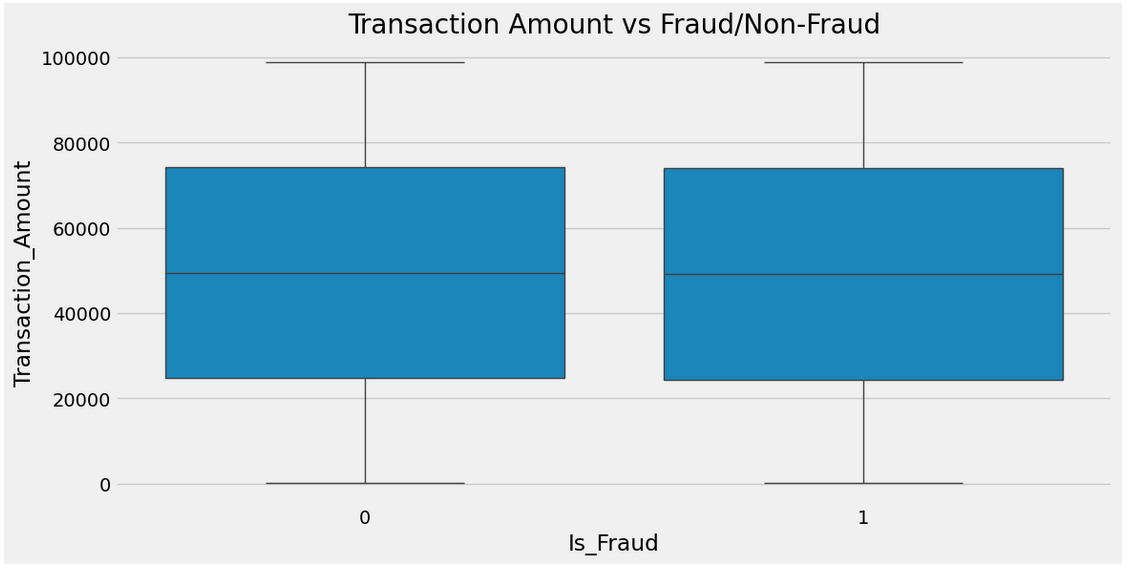

# Visualize fraud transactions based on 'Transaction_Amount'

plt.figure(figsize=(12, 6))

sns.boxplot(x='Is_Fraud', y='Transaction_Amount', data=df)

plt.title("Transaction Amount vs Fraud/Non-Fraud")

plt.show()

Output

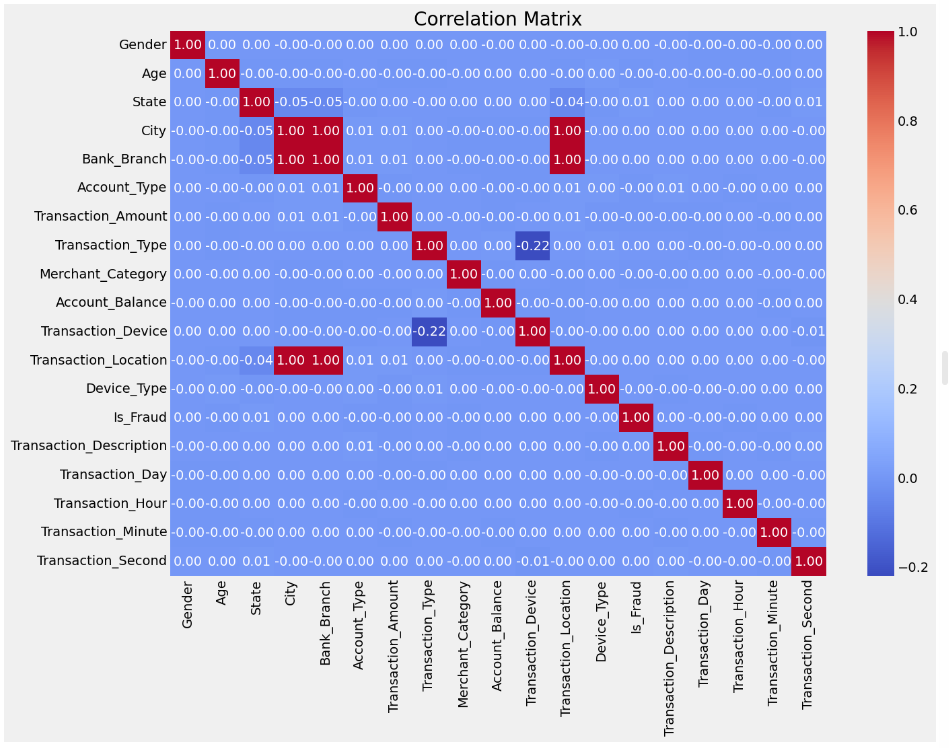

Stage 8 - Plot Correlation Matrix to Understand Feature Relationships

plt.figure(figsize=(14, 10))

correlation_matrix = df.corr()

sns.heatmap(correlation_matrix, annot=True, cmap='coolwarm', fmt=".2f")

plt.title("Correlation Matrix")

plt.show()

Output

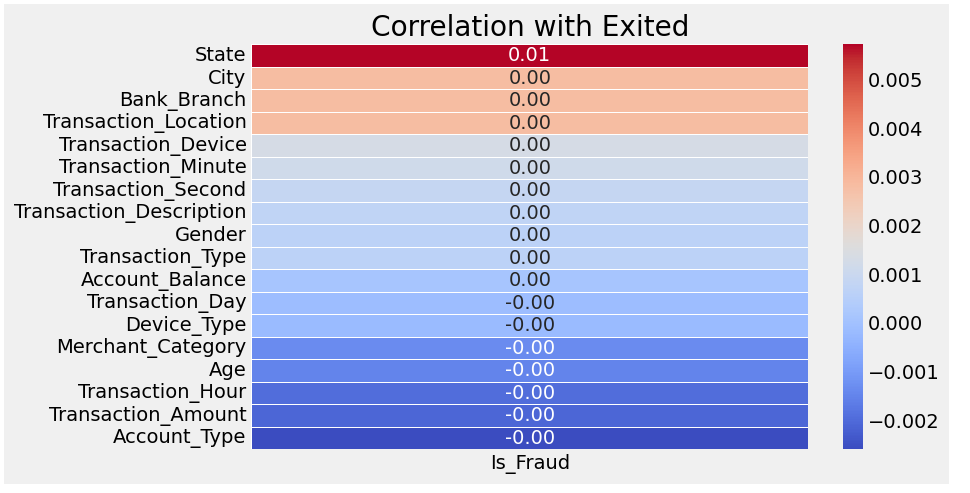

# Calculate correlation matrix for numerical columns

correlation_matrix = df.corr()

# Extract correlation with 'Exited' and drop 'Exited' itself

correlation_price = correlation_matrix['Is_Fraud'].sort_values(ascending=False).drop('Is_Fraud')

# Plot the heatmap for the correlation with 'Exited'

plt.figure(figsize=(8, 5))

sns.heatmap(correlation_price.to_frame(), annot=True, cmap='coolwarm', fmt='.2f', linewidths=0.5)

plt.title('Correlation with Exited')

plt.show()

Output

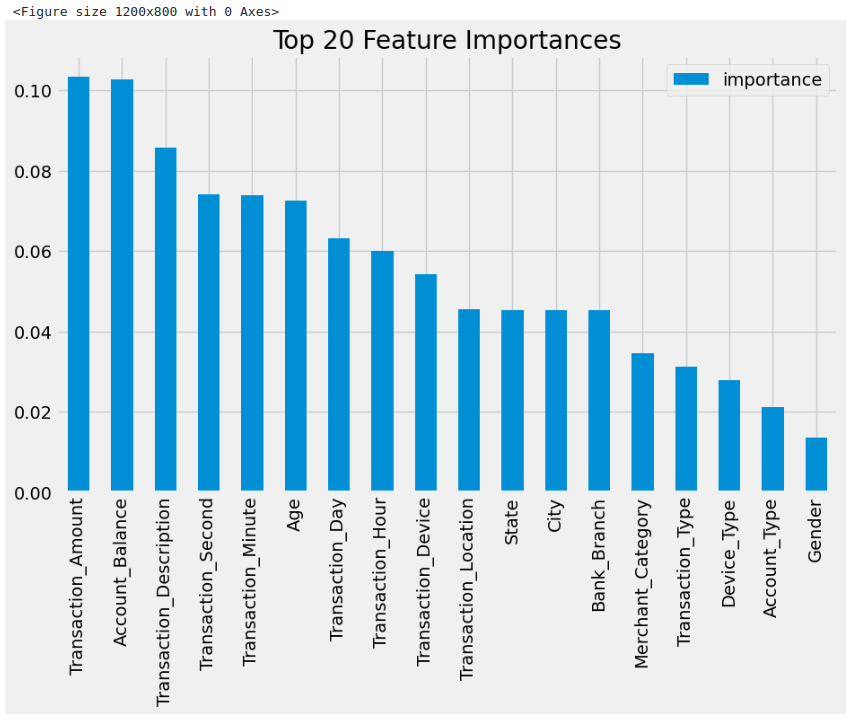

Stage 9 - Feature Importance using Random Forest

rf = RandomForestClassifier(n_estimators=100, random_state=42)

X = df.drop(columns=['Is_Fraud'])

y = df['Is_Fraud']

print("Shape for X Dataframe: ", X.shape)

print("Columns for X Dataframe: ", X.columns)

print("-"*50)

print("Shape for y Dataframe: ", y.shape)

Output

Shape for y Dataframe: (200000,)

# Train the model

rf.fit(X, y)

# Get feature importances

feature_importances = pd.DataFrame(rf.feature_importances_, index=X.columns, columns=['importance'])

feature_importances = feature_importances.sort_values('importance', ascending=False)

# Plot feature importances

plt.figure(figsize=(12, 8))

feature_importances.head(20).plot(kind='bar', figsize=(10, 6))

plt.title("Top 20 Feature Importances")

plt.show()

Output

Stage 10 - Select Only Important Features

# Select features with importance greater than a threshold (e.g., 0.01)

important_features = feature_importances[feature_importances['importance'] > 0.01].index

X = df[important_features]

print("Shape for X Dataframe: ", X.shape)

print("Columns for X Dataframe: ", X.columns)

Output

Shape for X Dataframe: (200000, 18)

Columns for X Dataframe: Index(['Transaction_Amount', 'Account_Balance', 'Transaction_Description',

'Transaction_Second', 'Transaction_Minute', 'Age', 'Transaction_Day',

'Transaction_Hour', 'Transaction_Device', 'Transaction_Location',

'State', 'City', 'Bank_Branch', 'Merchant_Category', 'Transaction_Type',

'Device_Type', 'Account_Type', 'Gender'],

dtype='object')

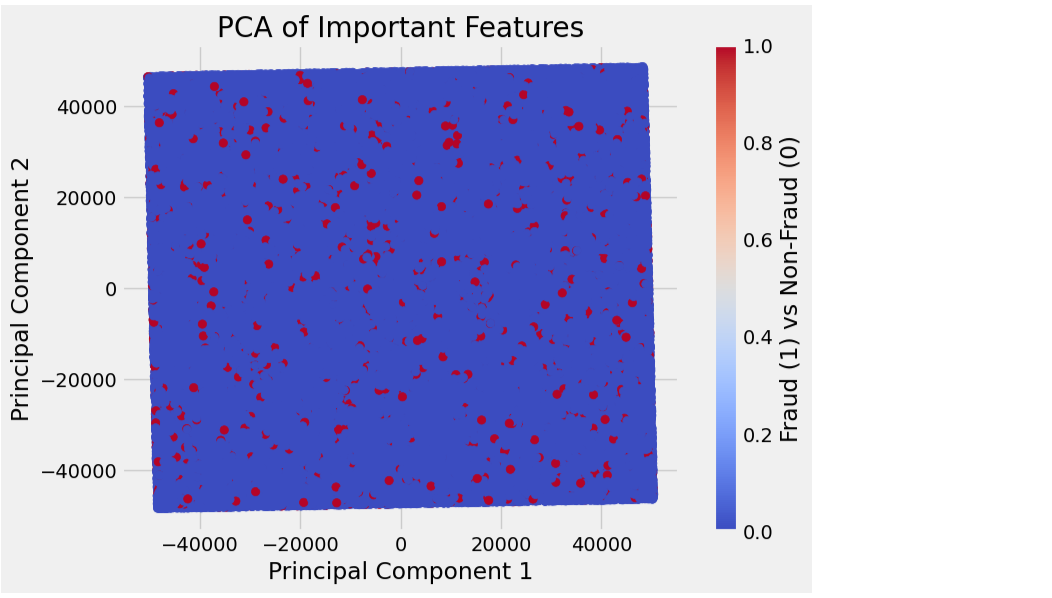

Stage 11 - Perform PCA (Principal Component Analysis)

pca = PCA(n_components=2) # Reducing to 2 components for visualization

X_pca = pca.fit_transform(X)

# Plot PCA results

plt.figure(figsize=(8, 6))

plt.scatter(X_pca[:, 0], X_pca[:, 1], c=y, cmap='coolwarm')

plt.title("PCA of Important Features")

plt.xlabel("Principal Component 1")

plt.ylabel("Principal Component 2")

plt.colorbar(label='Fraud (1) vs Non-Fraud (0)')

plt.show()

Output

Stage 12 - Train-test Split

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

Stage 13 - Feature Scaling

scaler = StandardScaler()

X_train_scaled = scaler.fit_transform(X_train)

X_test_scaled = scaler.transform(X_test)

Stage 14 - Model Training and Evaluation

# Define models

models = {

'Logistic Regression': LogisticRegression(),

'Decision Tree': DecisionTreeClassifier(),

'Random Forest': RandomForestClassifier(),

'Gradient Boosting': GradientBoostingClassifier(),

'XGBoost': xgb.XGBClassifier(),

'LightGBM': lgb.LGBMClassifier(),

'CatBoost': cb.CatBoostClassifier(silent=True),

'AdaBoost': AdaBoostClassifier(),

'Bagging': BaggingClassifier(),

'KNN': KNeighborsClassifier()

# 'SVM (RBF)': SVC(kernel='rbf', probability=True),

# 'SVM (Linear)': LinearSVC(),

# 'GaussianNB': GaussianNB()

# 'LDA': LDA(),

# 'QDA': QuadraticDiscriminantAnalysis(),

# 'Ridge Classifier': RidgeClassifier(),

}

# Define reduced parameter grids

param_grids = {

'Logistic Regression': {

'C': [0.1, 1],

'solver': ['liblinear'],

'penalty': ['l2']

},

'Decision Tree': {

'max_depth': [5, 10],

'min_samples_split': [2, 5],

'min_samples_leaf': [1, 2]

},

'Random Forest': {

'n_estimators': [50, 100],

'max_depth': [10],

'min_samples_split': [2],

'min_samples_leaf': [1]

},

'Gradient Boosting': {

'n_estimators': [100],

'learning_rate': [0.1],

'max_depth': [5]

},

'XGBoost': {

'n_estimators': [100],

'learning_rate': [0.1],

'max_depth': [5],

'subsample': [0.8, 1.0]

},

'SVM (RBF)': {

'C': [1, 10],

'gamma': ['scale', 'auto']

},

'SVM (Linear)': {

'C': [1, 10],

},

'LightGBM': {

'n_estimators': [100],

'learning_rate': [0.1],

'max_depth': [3, 5],

},

'CatBoost': {

'iterations': [100],

'learning_rate': [0.1],

'depth': [3, 5]

},

'KNN': {

'n_neighbors': [3],

'weights': ['uniform', 'distance']

},

'AdaBoost': {

'n_estimators': [100],

'learning_rate': [0.01, 0.1]

},

'Bagging': {

'n_estimators': [100],

'max_samples': [0.8, 1.0]

},

'LDA': {},

'QDA': {},

'Ridge Classifier': {

'alpha': [0.1, 1]

},

'GaussianNB': {}

}

# Initialize an empty dictionary to store results

model_results = {}

# Handle class imbalance by computing class weights for each model that supports it

class_weights = compute_class_weight('balanced', classes=np.array([0, 1]), y=y_train)

class_weight_dict = {0: class_weights[0], 1: class_weights[1]}

print("class_weight_dict: ", class_weight_dict)

# Handle SMOTE for class imbalance

smote = SMOTE(sampling_strategy='auto', random_state=42)

X_train_smote, y_train_smote = smote.fit_resample(X_train_scaled, y_train)

# Evaluate models with GridSearchCV

for model_name, model in models.items():

print(f"Training model with GridSearchCV: {model_name}")

# Get the parameter grid for the model

param_grid = param_grids[model_name]

# Modify model to include class weights where applicable

if model_name in ['Logistic Regression', 'Random Forest', 'SVM (RBF)', 'SVM (Linear)']:

# Assign class weights for models that support it

if model_name == 'Logistic Regression':

model = LogisticRegression(class_weight='balanced')

elif model_name == 'Random Forest':

model = RandomForestClassifier(class_weight='balanced')

elif model_name in ['SVM (RBF)', 'SVM (Linear)']:

model = SVC(probability=True, class_weight='balanced') if model_name == 'SVM (RBF)' else LinearSVC(class_weight='balanced')

# Perform GridSearchCV with parallelism

grid_search = GridSearchCV(estimator=model, param_grid=param_grid, cv=3, n_jobs=-1, verbose=2)

# Fit the model with the best parameters using the resampled data

grid_search.fit(X_train_smote, y_train_smote)

# Get the best model and its parameters

best_model = grid_search.best_estimator_

print(f"Best parameters for {model_name}: {grid_search.best_params_}")

# Predict on both train and test sets

y_train_pred = best_model.predict(X_train_smote)

y_test_pred = best_model.predict(X_test_scaled)

# Store the results

model_results[model_name] = {

'train_accuracy': best_model.score(X_train_smote, y_train_smote),

'test_accuracy': best_model.score(X_test_scaled, y_test),

'y_test': y_test,

'y_test_pred': y_test_pred,

'classification_report': classification_report(y_test, y_test_pred),

'roc_auc': roc_auc_score(y_test, best_model.predict_proba(X_test_scaled)[:, 1])

}

# Print results after all models are evaluated

print("\nModel Evaluation Results:")

print(f"Model: {model_results[model_name]}\n")

print(f"Train Accuracy: {model_results[model_name]['train_accuracy']:.4f}")

print(f"Test Accuracy: {model_results[model_name]['test_accuracy']:.4f}")

print(f"ROC AUC: {model_results[model_name]['roc_auc']:.4f}\n")

print(f"Classification Report:\n{model_results[model_name]['classification_report']}")

print("-" * 80)

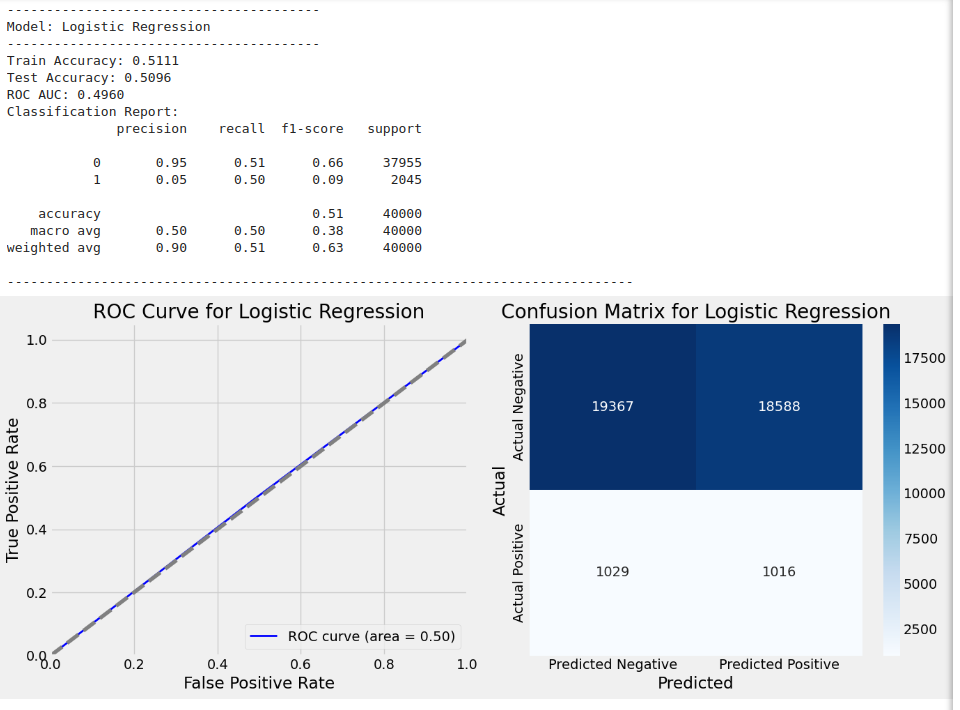

Output

class_weight_dict: {0: 0.5264647235731161, 1: 9.946537361680965}

Training model with GridSearchCV: Logistic Regression

-----------------------------------------------------

Fitting 3 folds for each of 2 candidates, totalling 6 fits

Best parameters for Logistic Regression: {'C': 0.1, 'penalty': 'l2', 'solver': 'liblinear'}

Model Evaluation Results:

Model: {'train_accuracy': 0.5110919536447811, 'test_accuracy': 0.509575, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 1, 1, ..., 1, 1, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 0.51 0.66 37955\n 1 0.05 0.50 0.09 2045\n\n accuracy 0.51 40000\n macro avg 0.50 0.50 0.38 40000\nweighted avg 0.90 0.51 0.63 40000\n', 'roc_auc': 0.49595028728847923}

Train Accuracy: 0.5111

Test Accuracy: 0.5096

ROC AUC: 0.4960

Classification Report:

precision recall f1-score support

0 0.95 0.51 0.66 37955

1 0.05 0.50 0.09 2045

accuracy 0.51 40000

macro avg 0.50 0.50 0.38 40000

weighted avg 0.90 0.51 0.63 40000

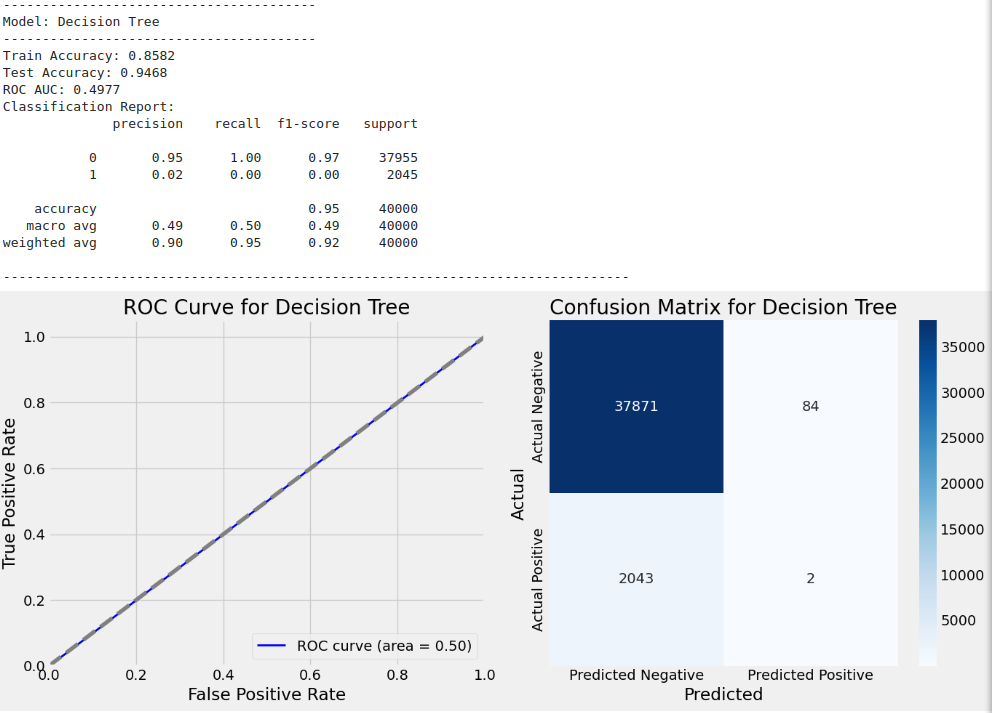

Training model with GridSearchCV: Decision Tree

-----------------------------------------------

Fitting 3 folds for each of 8 candidates, totalling 24 fits

Best parameters for Decision Tree: {'max_depth': 10, 'min_samples_leaf': 2, 'min_samples_split': 5}

Model Evaluation Results:

Model: {'train_accuracy': 0.8582065979191482, 'test_accuracy': 0.946825, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 0, ..., 0, 0, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 1.00 0.97 37955\n 1 0.02 0.00 0.00 2045\n\n accuracy 0.95 40000\n macro avg 0.49 0.50 0.49 40000\nweighted avg 0.90 0.95 0.92 40000\n', 'roc_auc': 0.4977343714519736}

Train Accuracy: 0.8582

Test Accuracy: 0.9468

ROC AUC: 0.4977

Classification Report:

precision recall f1-score support

0 0.95 1.00 0.97 37955

1 0.02 0.00 0.00 2045

accuracy 0.95 40000

macro avg 0.49 0.50 0.49 40000

weighted avg 0.90 0.95 0.92 40000

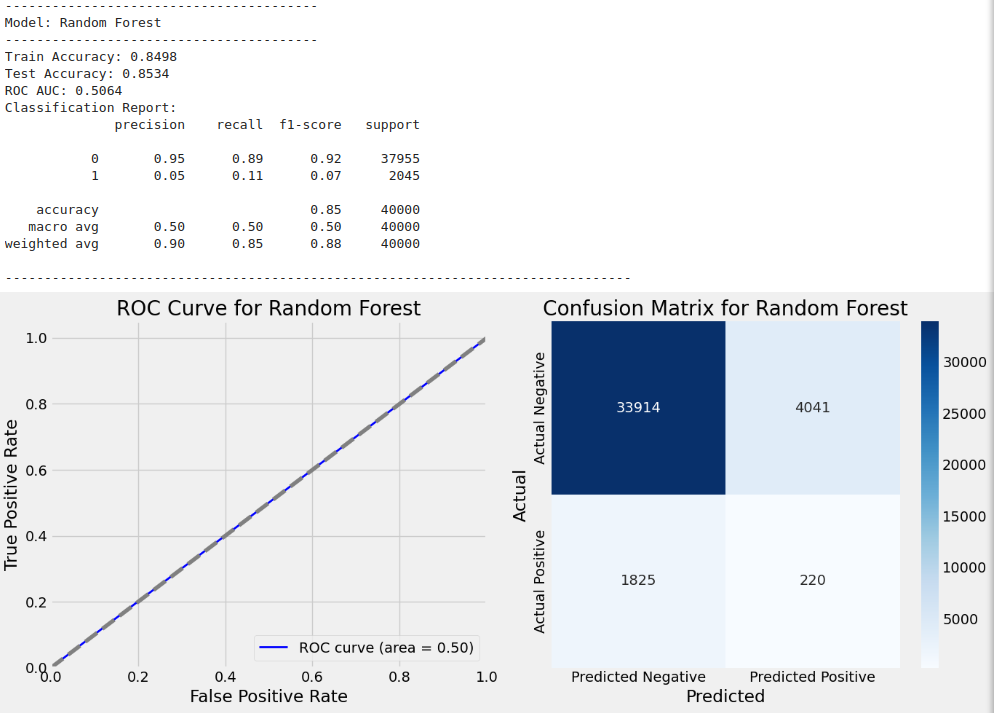

Training model with GridSearchCV: Random Forest

-----------------------------------------------

Fitting 3 folds for each of 2 candidates, totalling 6 fits

Best parameters for Random Forest: {'max_depth': 10, 'min_samples_leaf': 1, 'min_samples_split': 2, 'n_estimators': 50}

Model Evaluation Results:

Model: {'train_accuracy': 0.8498127759826793, 'test_accuracy': 0.85335, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 0, ..., 0, 0, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 0.89 0.92 37955\n 1 0.05 0.11 0.07 2045\n\n accuracy 0.85 40000\n macro avg 0.50 0.50 0.50 40000\nweighted avg 0.90 0.85 0.88 40000\n', 'roc_auc': 0.5063503975722118}

Train Accuracy: 0.8498

Test Accuracy: 0.8534

ROC AUC: 0.5064

Classification Report:

precision recall f1-score support

0 0.95 0.89 0.92 37955

1 0.05 0.11 0.07 2045

accuracy 0.85 40000

macro avg 0.50 0.50 0.50 40000

weighted avg 0.90 0.85 0.88 40000

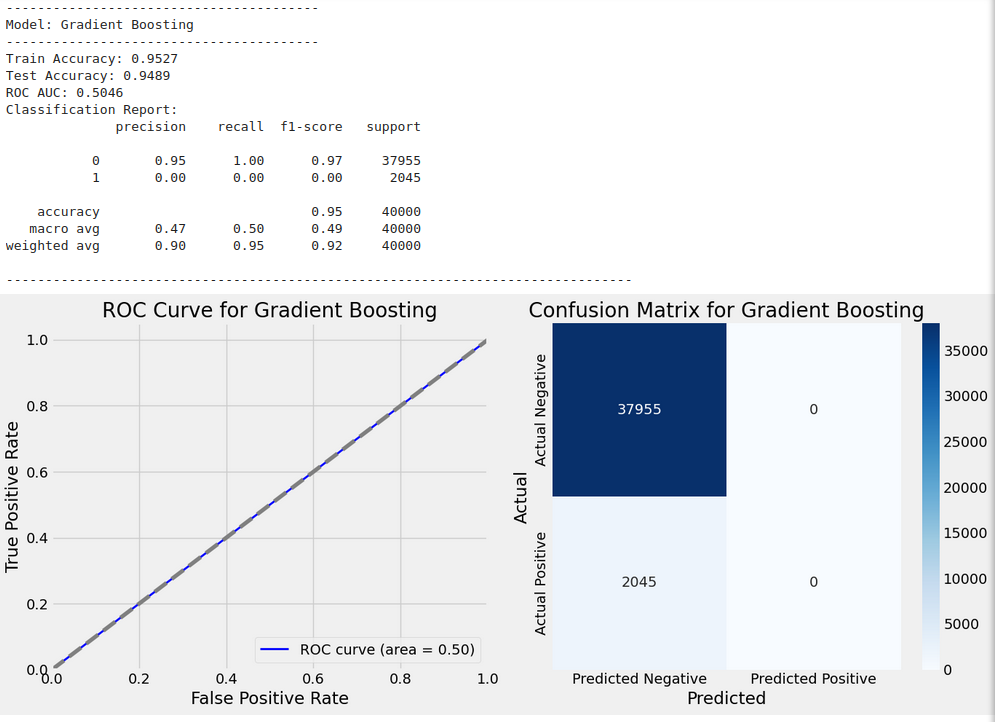

Training model with GridSearchCV: Gradient Boosting

---------------------------------------------------

Fitting 3 folds for each of 1 candidates, totalling 3 fits

[CV] END max_depth=5, min_samples_leaf=1, min_samples_split=2; total time= 1.8s

[CV] END max_depth=5, min_samples_leaf=1, min_samples_split=2; total time= 2.0s

[CV] END max_depth=5, min_samples_leaf=2, min_samples_split=5; total time= 1.8s

[CV] END max_depth=5, min_samples_leaf=2, min_samples_split=5; total time= 1.9s

[CV] END max_depth=5, min_samples_leaf=1, min_samples_split=5; total time= 1.7s

[CV] END max_depth=5, min_samples_leaf=1, min_samples_split=5; total time= 2.0s

[CV] END max_depth=5, min_samples_leaf=1, min_samples_split=2; total time= 1.9s

[CV] END ................C=0.1, penalty=l2, solver=liblinear; total time= 0.3s

[CV] END max_depth=10, min_samples_leaf=2, min_samples_split=5; total time= 2.6s

[CV] END ..................C=1, penalty=l2, solver=liblinear; total time= 0.3s

[CV] END max_depth=10, min_samples_leaf=2, min_samples_split=5; total time= 2.9s

[CV] END max_depth=10, min_samples_leaf=2, min_samples_split=5; total time= 2.5s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2; total time= 2.6s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=5; total time= 2.6s

[CV] END max_depth=10, min_samples_leaf=2, min_samples_split=2; total time= 2.6s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=5; total time= 2.6s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=5; total time= 2.7s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2; total time= 2.7s

[CV] END max_depth=10, min_samples_leaf=2, min_samples_split=2; total time= 2.7s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2; total time= 2.8s

[CV] END max_depth=10, min_samples_leaf=2, min_samples_split=2; total time= 2.8s

[CV] END ..................C=1, penalty=l2, solver=liblinear; total time= 0.7s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2, n_estimators=50; total time= 19.5s

[CV] END ................C=0.1, penalty=l2, solver=liblinear; total time= 0.6s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2, n_estimators=50; total time= 19.7s

[CV] END ................C=0.1, penalty=l2, solver=liblinear; total time= 0.6s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2, n_estimators=50; total time= 19.8s

[CV] END max_depth=5, min_samples_leaf=2, min_samples_split=2; total time= 1.7s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2, n_estimators=100; total time= 37.4s

[CV] END max_depth=5, min_samples_leaf=1, min_samples_split=5; total time= 1.6s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2, n_estimators=100; total time= 37.4s

[CV] END ..................C=1, penalty=l2, solver=liblinear; total time= 0.8s

[CV] END max_depth=10, min_samples_leaf=1, min_samples_split=2, n_estimators=100; total time= 38.3s

Best parameters for Gradient Boosting: {'learning_rate': 0.1, 'max_depth': 5, 'n_estimators': 100}

Model Evaluation Results:

Model: {'train_accuracy': 0.9527168870140895, 'test_accuracy': 0.948875, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 0, ..., 0, 0, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 1.00 0.97 37955\n 1 0.00 0.00 0.00 2045\n\n accuracy 0.95 40000\n macro avg 0.47 0.50 0.49 40000\nweighted avg 0.90 0.95 0.92 40000\n', 'roc_auc': 0.5045642649141516}

Train Accuracy: 0.9527

Test Accuracy: 0.9489

ROC AUC: 0.5046

Classification Report:

precision recall f1-score support

0 0.95 1.00 0.97 37955

1 0.00 0.00 0.00 2045

accuracy 0.95 40000

macro avg 0.47 0.50 0.49 40000

weighted avg 0.90 0.95 0.92 40000

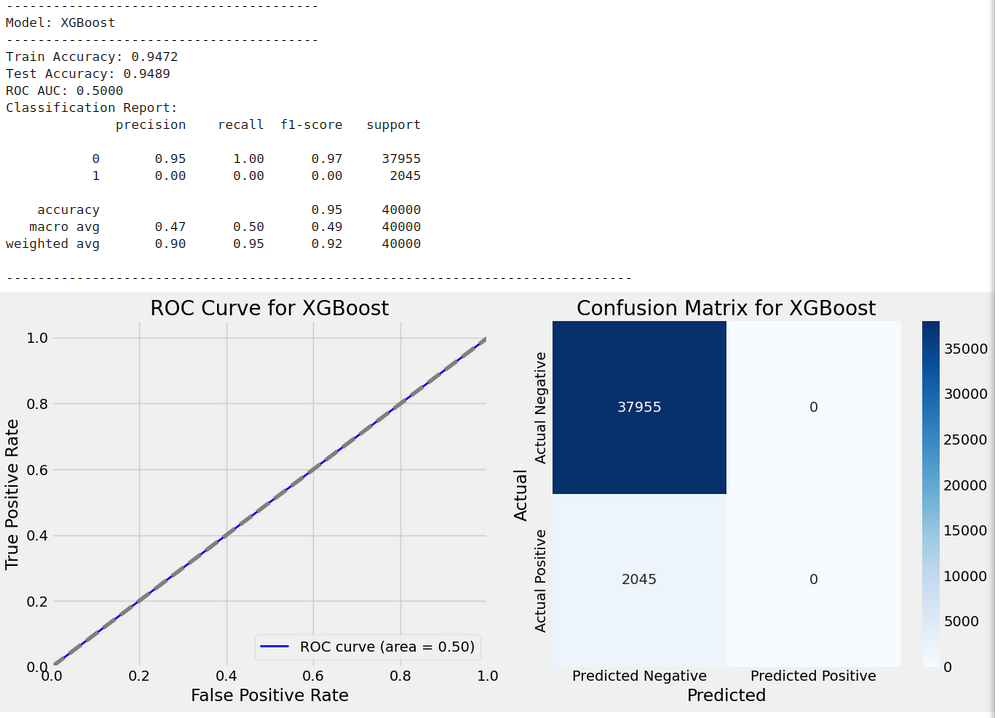

Training model with GridSearchCV: XGBoost

Fitting 3 folds for each of 2 candidates, totalling 6 fits

Best parameters for XGBoost: {'learning_rate': 0.1, 'max_depth': 5, 'n_estimators': 100, 'subsample': 1.0}

Model Evaluation Results:

Model: {'train_accuracy': 0.9471528129668262, 'test_accuracy': 0.948875, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 0, ..., 0, 0, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 1.00 0.97 37955\n 1 0.00 0.00 0.00 2045\n\n accuracy 0.95 40000\n macro avg 0.47 0.50 0.49 40000\nweighted avg 0.90 0.95 0.92 40000\n', 'roc_auc': 0.49996872502793327}

Train Accuracy: 0.9472

Test Accuracy: 0.9489

ROC AUC: 0.5000

Classification Report:

precision recall f1-score support

0 0.95 1.00 0.97 37955

1 0.00 0.00 0.00 2045

accuracy 0.95 40000

macro avg 0.47 0.50 0.49 40000

weighted avg 0.90 0.95 0.92 40000

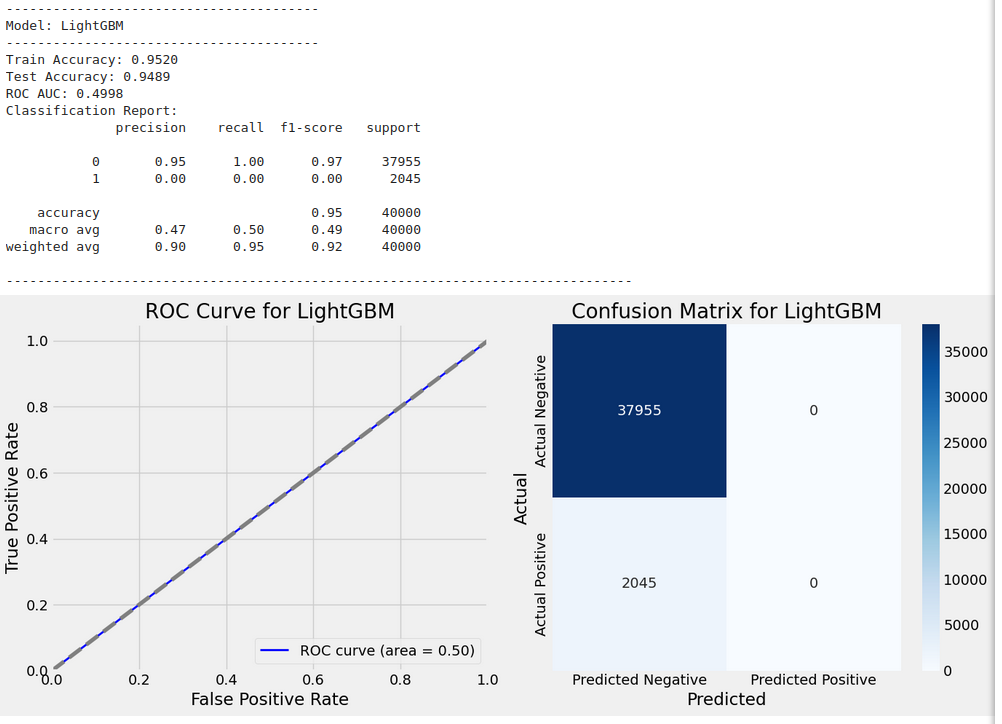

Training model with GridSearchCV: LightGBM

------------------------------------------

[LightGBM] [Info] Number of positive: 151957, number of negative: 151957

[LightGBM] [Info] Auto-choosing row-wise multi-threading, the overhead of testing was 0.002153 seconds.

You can set `force_row_wise=true` to remove the overhead.

And if memory is not enough, you can set `force_col_wise=true`.

[LightGBM] [Info] Total Bins 4584

[LightGBM] [Info] Number of data points in the train set: 303914, number of used features: 18

[LightGBM] [Info] [binary:BoostFromScore]: pavg=0.500000 -> initscore=0.000000

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

Best parameters for LightGBM: {'learning_rate': 0.1, 'max_depth': 5, 'n_estimators': 100}

Model Evaluation Results:

Model: {'train_accuracy': 0.9520357732779668, 'test_accuracy': 0.948875, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 0, ..., 0, 0, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 1.00 0.97 37955\n 1 0.00 0.00 0.00 2045\n\n accuracy 0.95 40000\n macro avg 0.47 0.50 0.49 40000\nweighted avg 0.90 0.95 0.92 40000\n', 'roc_auc': 0.4997815261220097}

Train Accuracy: 0.9520

Test Accuracy: 0.9489

ROC AUC: 0.4998

Classification Report:

precision recall f1-score support

0 0.95 1.00 0.97 37955

1 0.00 0.00 0.00 2045

accuracy 0.95 40000

macro avg 0.47 0.50 0.49 40000

weighted avg 0.90 0.95 0.92 40000

Training model with GridSearchCV: CatBoost

-------------------------------------------

Fitting 3 folds for each of 2 candidates, totalling 6 fits

Best parameters for CatBoost: {'depth': 5, 'iterations': 100, 'learning_rate': 0.1}

Model Evaluation Results:

Model: {'train_accuracy': 0.9496864244490217, 'test_accuracy': 0.948875, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 0, ..., 0, 0, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 1.00 0.97 37955\n 1 0.00 0.00 0.00 2045\n\n accuracy 0.95 40000\n macro avg 0.47 0.50 0.49 40000\nweighted avg 0.90 0.95 0.92 40000\n', 'roc_auc': 0.49888715854800386}

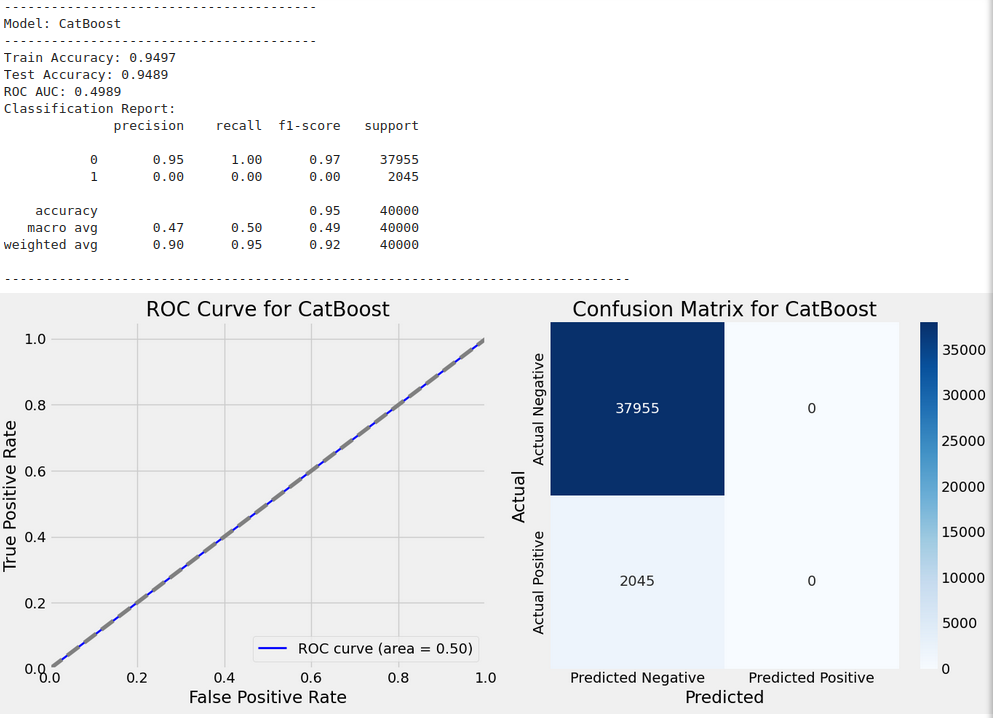

Train Accuracy: 0.9497

Test Accuracy: 0.9489

ROC AUC: 0.4989

Classification Report:

precision recall f1-score support

0 0.95 1.00 0.97 37955

1 0.00 0.00 0.00 2045

accuracy 0.95 40000

macro avg 0.47 0.50 0.49 40000

weighted avg 0.90 0.95 0.92 40000

Training model with GridSearchCV: AdaBoost

------------------------------------------

Fitting 3 folds for each of 2 candidates, totalling 6 fits

[CV] END max_depth=5, min_samples_leaf=2, min_samples_split=2; total time= 1.7s

[CV] END ...learning_rate=0.1, max_depth=5, n_estimators=100; total time= 2.2min

[CV] END learning_rate=0.1, max_depth=5, n_estimators=100, subsample=0.8; total time= 1.2s

[CV] END max_depth=5, min_samples_leaf=2, min_samples_split=2; total time= 1.7s

[CV] END ...learning_rate=0.1, max_depth=5, n_estimators=100; total time= 2.3min

[CV] END learning_rate=0.1, max_depth=5, n_estimators=100, subsample=0.8; total time= 1.3s

[CV] END max_depth=5, min_samples_leaf=2, min_samples_split=5; total time= 1.7s

[CV] END ...learning_rate=0.1, max_depth=5, n_estimators=100; total time= 2.3min

[CV] END learning_rate=0.1, max_depth=5, n_estimators=100, subsample=0.8; total time= 1.3s

[CV] END learning_rate=0.1, max_depth=5, n_estimators=100, subsample=1.0; total time= 1.2s

[CV] END learning_rate=0.1, max_depth=5, n_estimators=100, subsample=1.0; total time= 1.3s

[CV] END learning_rate=0.1, max_depth=5, n_estimators=100, subsample=1.0; total time= 1.3s

Best parameters for AdaBoost: {'learning_rate': 0.1, 'n_estimators': 100}

Model Evaluation Results:

Model: {'train_accuracy': 0.629306316918602, 'test_accuracy': 0.486475, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 0, ..., 1, 1, 1]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 0.48 0.64 37955\n 1 0.05 0.52 0.09 2045\n\n accuracy 0.49 40000\n macro avg 0.50 0.50 0.37 40000\nweighted avg 0.90 0.49 0.61 40000\n', 'roc_auc': 0.5060679179017489}

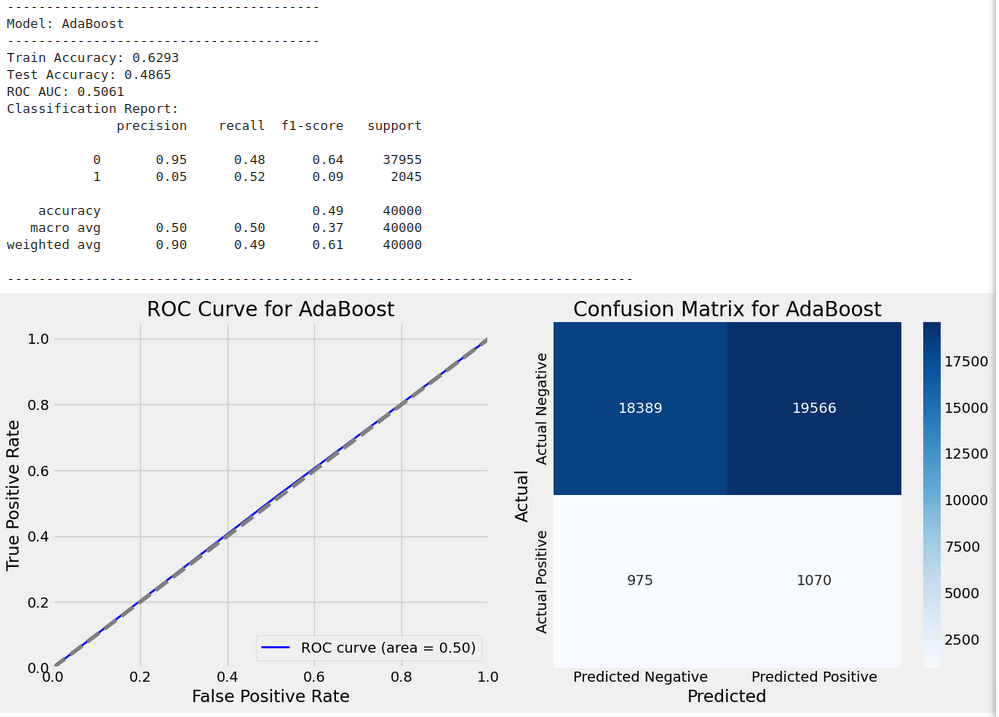

Train Accuracy: 0.6293

Test Accuracy: 0.4865

ROC AUC: 0.5061

Classification Report:

precision recall f1-score support

0 0.95 0.48 0.64 37955

1 0.05 0.52 0.09 2045

accuracy 0.49 40000

macro avg 0.50 0.50 0.37 40000

weighted avg 0.90 0.49 0.61 40000

Training model with GridSearchCV: Bagging

-----------------------------------------

Fitting 3 folds for each of 2 candidates, totalling 6 fits

[CV] END .........depth=3, iterations=100, learning_rate=0.1; total time= 2.1s

[CV] END .........depth=3, iterations=100, learning_rate=0.1; total time= 2.1s

[CV] END .........depth=3, iterations=100, learning_rate=0.1; total time= 2.2s

[CV] END .........depth=5, iterations=100, learning_rate=0.1; total time= 2.3s

[CV] END .........depth=5, iterations=100, learning_rate=0.1; total time= 2.3s

[CV] END .........depth=5, iterations=100, learning_rate=0.1; total time= 2.3s

[CV] END ...............learning_rate=0.01, n_estimators=100; total time= 33.5s

[CV] END ................learning_rate=0.1, n_estimators=100; total time= 33.7s

[CV] END ................learning_rate=0.1, n_estimators=100; total time= 33.9s

[CV] END ...............learning_rate=0.01, n_estimators=100; total time= 34.0s

[CV] END ...............learning_rate=0.01, n_estimators=100; total time= 34.9s

[CV] END ................learning_rate=0.1, n_estimators=100; total time= 35.0s

[LightGBM] [Info] Number of positive: 101305, number of negative: 101305

[LightGBM] [Info] Auto-choosing col-wise multi-threading, the overhead of testing was 0.157509 seconds.

...

### ----------------

### ---- more details - see notebook for this cell

### -----------------

...

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[LightGBM] [Warning] No further splits with positive gain, best gain: -inf

[CV] END ...learning_rate=0.1, max_depth=5, n_estimators=100; total time= 3.4min

[CV] END ..................max_samples=1.0, n_estimators=100; total time= 3.4min

Model Evaluation Results:

Model: {'train_accuracy': 0.999990128786433, 'test_accuracy': 0.948725, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 0, ..., 0, 0, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 1.00 0.97 37955\n 1 0.00 0.00 0.00 2045\n\n accuracy 0.95 40000\n macro avg 0.47 0.50 0.49 40000\nweighted avg 0.90 0.95 0.92 40000\n', 'roc_auc': 0.5051717981562905}

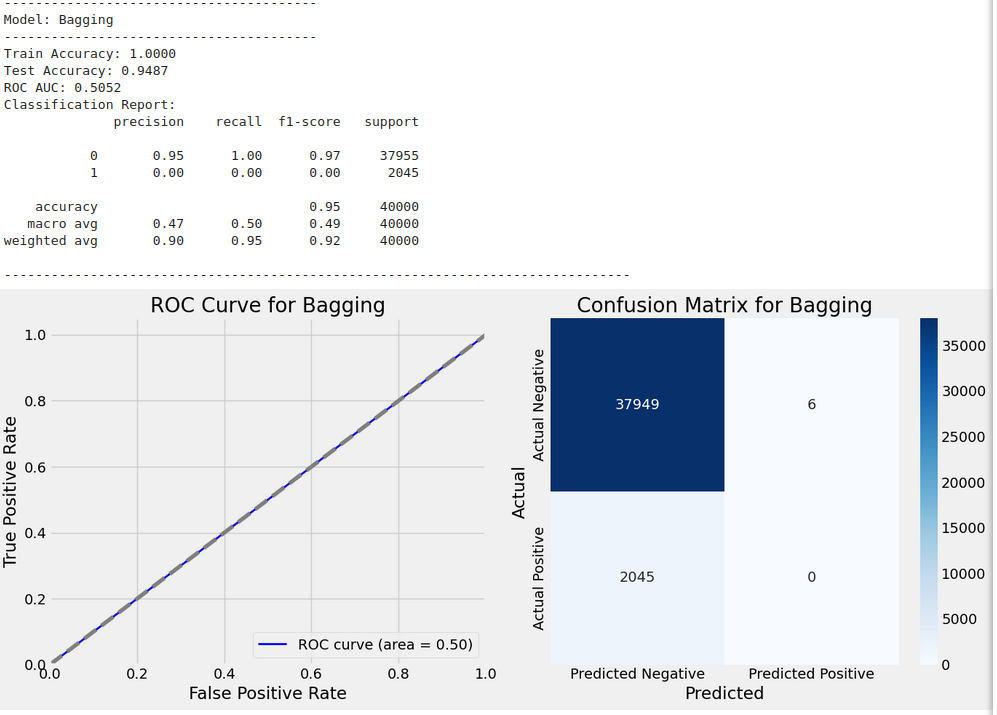

Train Accuracy: 1.0000

Test Accuracy: 0.9487

ROC AUC: 0.5052

Classification Report:

precision recall f1-score support

0 0.95 1.00 0.97 37955

1 0.00 0.00 0.00 2045

accuracy 0.95 40000

macro avg 0.47 0.50 0.49 40000

weighted avg 0.90 0.95 0.92 40000

Training model with GridSearchCV: KNN

-------------------------------------

Fitting 3 folds for each of 2 candidates, totalling 6 fits

Best parameters for KNN: {'n_neighbors': 3, 'weights': 'distance'}

Model Evaluation Results:

Model: {'train_accuracy': 1.0, 'test_accuracy': 0.7367, 'y_test': 119737 0

72272 0

158154 0

65426 0

30074 0

..

4174 0

91537 0

156449 0

184376 0

6584 0

Name: Is_Fraud, Length: 40000, dtype: int64, 'y_test_pred': array([0, 0, 1, ..., 0, 0, 0]), 'classification_report': ' precision recall f1-score support\n\n 0 0.95 0.76 0.85 37955\n 1 0.05 0.23 0.08 2045\n\n accuracy 0.74 40000\n macro avg 0.50 0.50 0.46 40000\nweighted avg 0.90 0.74 0.81 40000\n', 'roc_auc': 0.4954215631108644}

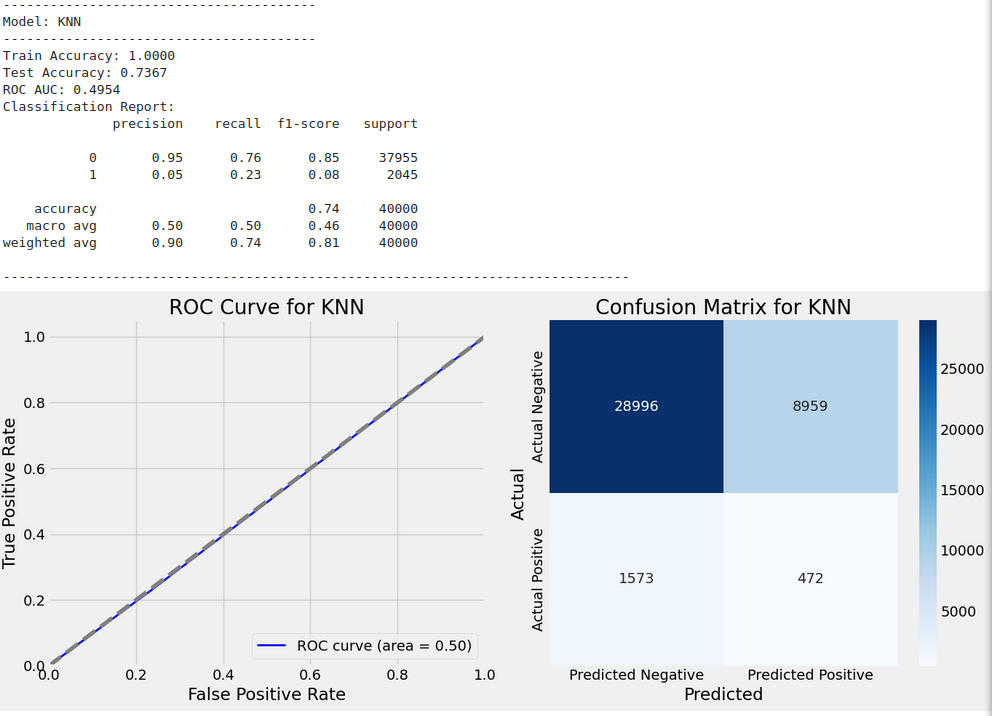

Train Accuracy: 1.0000

Test Accuracy: 0.7367

ROC AUC: 0.4954

Classification Report:

precision recall f1-score support

0 0.95 0.76 0.85 37955

1 0.05 0.23 0.08 2045

accuracy 0.74 40000

macro avg 0.50 0.50 0.46 40000

weighted avg 0.90 0.74 0.81 40000

Stage 15 - Displaying Evaluation Results for All Models

# # Print results after all models are evaluated

# print("\nModel Evaluation Results:")

# print(f"Model: {model_results[model_name]}\n")

# print(f"Train Accuracy: {model_results[model_name]['train_accuracy']:.4f}")

# print(f"Test Accuracy: {model_results[model_name]['test_accuracy']:.4f}")

# print(f"ROC AUC: {model_results[model_name]['roc_auc']:.4f}\n")

# print(f"Classification Report:\n{model_results[model_name]['classification_report']}")

# print("-" * 80)

Stage 16 - Plotting the Train Vs Test Accuracy Chart

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.metrics import confusion_matrix, classification_report, roc_curve, auc

# Initialize a list to store results for all models

results_list = []

# Iterate through the models to collect results and plot confusion matrix and ROC curve

for model_name, model in model_results.items():

# Extract the predicted values and actual values

y_test_pred = model['y_test_pred'] # Use the predicted labels

y_test = model['y_test'] # Actual true labels

# Extract metrics

train_accuracy = model['train_accuracy']

test_accuracy = model['test_accuracy']

roc_auc = model['roc_auc']

# Classification Report

clf_report = classification_report(y_test, y_test_pred)

# Print the model name followed by its evaluation metrics

print("-" * 40)

print(f"Model: {model_name}")

print("-" * 40)

print(f"Train Accuracy: {train_accuracy:.4f}")

print(f"Test Accuracy: {test_accuracy:.4f}")

print(f"ROC AUC: {roc_auc:.4f}")

print("Classification Report:")

print(clf_report)

print("-" * 80) # Separator line for clarity

# Generate confusion matrix

cm = confusion_matrix(y_test, y_test_pred)

# ROC Curve

fpr, tpr, _ = roc_curve(y_test, y_test_pred)

roc_auc_value = auc(fpr, tpr)

# Create subplots: 1 row, 2 columns

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(14, 6)) # Width, Height

# Plot ROC Curve on the first subplot

ax1.plot(fpr, tpr, color='b', lw=2, label=f'ROC curve (area = {roc_auc_value:.2f})')

ax1.plot([0, 1], [0, 1], color='gray', linestyle='--') # Random classifier line

ax1.set_xlim([0.0, 1.0])

ax1.set_ylim([0.0, 1.05])

ax1.set_xlabel('False Positive Rate')

ax1.set_ylabel('True Positive Rate')

ax1.set_title(f'ROC Curve for {model_name}')

ax1.legend(loc='lower right')

# Plot Confusion Matrix on the second subplot

sns.heatmap(cm, annot=True, fmt='d', cmap='Blues',

xticklabels=['Predicted Negative', 'Predicted Positive'],

yticklabels=['Actual Negative', 'Actual Positive'], ax=ax2)

ax2.set_title(f'Confusion Matrix for {model_name}')

ax2.set_xlabel('Predicted')

ax2.set_ylabel('Actual')

# Show both plots

plt.tight_layout()

plt.show()

# Append the results to the list for the DataFrame

results_list.append({

'Model': model_name,

'Train Accuracy': f"{train_accuracy:.4f}",

'Test Accuracy': f"{test_accuracy:.4f}",

'ROC AUC': f"{roc_auc:.4f}",

'Classification Report': clf_report

})

# Convert results into a DataFrame for better presentation

results_df = pd.DataFrame(results_list)

# Print the summary of results in a tabular format

# print("\nSummary of Model Evaluation Results:")

# print(results_df.to_string(index=False)) # Display as a pretty table

print("-" * 80)

Output

Stage 17 - Final Conclusion

Conclusion:

-

High Test Accuracy: The model achieved a high test accuracy, indicating that it correctly predicted most instances in the test set. This is a promising result for the overall performance of the model.

-

ROC AUC: The ROC AUC is nearly 0.5, which is close to random guessing. This suggests that the model struggles to distinguish between the two classes effectively. The low ROC AUC indicates poor discriminative power, especially for class 1.

-

Class Imbalance: The classification report highlights a significant class imbalance.

- Class 0 (majority class) has a high precision of 0.95 and recall of 1.00, with an F1-score of 0.97, indicating that the model performs very well on class 0.

- Class 1 (minority class) has very low precision (0.02) and recall (0.00), with an F1-score of 0.00, indicating that the model struggles severely to identify the minority class (class 1).

-

Impact of Class Imbalance: The poor performance on class 1 suggests that the model may be biased towards predicting the majority class (class 0), and thus failing to identify the minority class. This is supported by the low recall and precision for class 1.

-

Model Improvement Suggestions:

- Address Class Imbalance: Techniques such as resampling (SMOTE), class weights adjustment, or using more balanced metrics like F1-score for class 1 can help improve the model's ability to detect the minority class.

- Model Tuning: Exploring other models or hyperparameters to better balance accuracy across both classes may improve performance.

-

Final Remarks: While the model shows strong performance in terms of overall accuracy, it is heavily biased towards the majority class, which makes it unreliable for detecting the minority class. Addressing the class imbalance should be a priority for improving model performance in real-world scenarios.

Final Remarks:

-

The model demonstrates strong overall accuracy, indicating its ability to correctly predict the majority of instances within the dataset.

-

There is a noticeable discrepancy between training and testing accuracy, which may suggest some degree of overfitting, although the difference is not extreme.

-

The ROC AUC score is close to random guessing, indicating that the model struggles with distinguishing between the two classes, especially for the minority class.

-

Class imbalance is a significant issue, as the model shows excellent performance on the majority class but fails to effectively identify the minority class.

-

Precision and recall for the majority class are very high, showcasing that the model can accurately predict this class without many false positives or negatives.

-

The performance for the minority class is poor, with the model having difficulty detecting and correctly predicting instances of this class.

-

The model's inability to perform well on the minority class suggests a bias toward the majority class, which reduces its overall usefulness in cases where detecting the minority class is important.

-

There is an imbalance between the precision and recall of the two classes, with the model being much more sensitive to the majority class.

-

Improvements to the model should focus on addressing class imbalance, such as through resampling techniques, class weighting, or exploring alternative models that are more adept at handling skewed distributions.

-

The current model, while performing well on the majority class, needs further optimization and tuning to ensure it can reliably detect the minority class and be more robust across all categories.

On the base + sources:

Bank Transaction Fraud Detection (Accuracy: 95%)