Tesla Stock Price Prediction

Objective and Overview

The primary objective of this analysis was to predict Tesla’s stock closing prices based on historical data. Using machine learning techniques, the goal was to evaluate the model's performance and make accurate predictions while identifying key drivers of stock price movements.

Steps Taken

Data Collection and Processing:

- Loaded historical Tesla stock price data.

- Preprocessed the data by cleaning columns (e.g., removing special characters like $) and converting them into numeric format.

- Checked for and handled missing values to ensure data integrity.

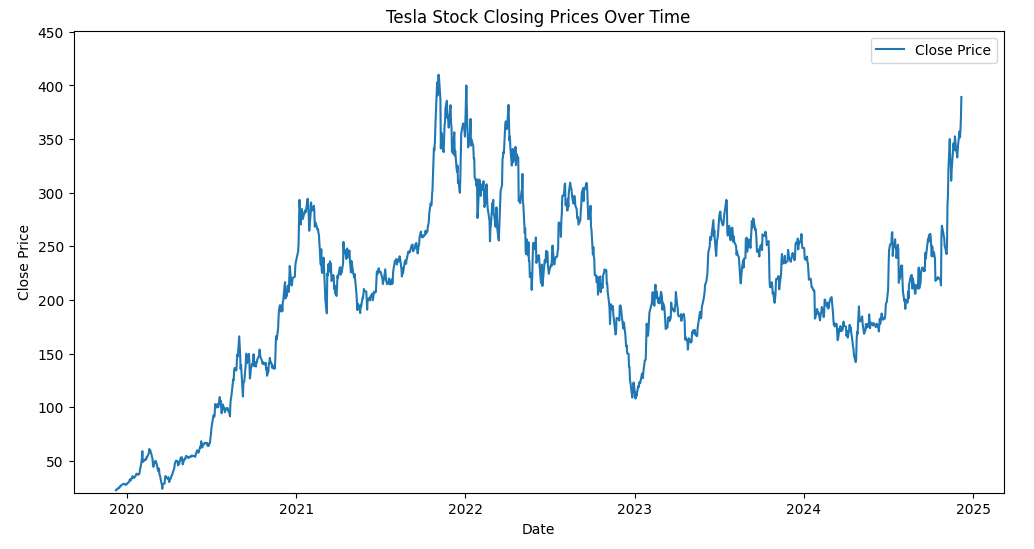

- Visualized Past Trend data before making my model to better grasp the volatility and trend visually

Model Training:

-

Created lagging features (Close_t-1, Close_t-2, etc.), moving averages (e.g., 7_day_avg, 30_day_avg), and volatility metrics (e.g., 7_day_volatility) to capture trends and patterns in stock prices.

- Split the dataset into training and testing sets using an 80-20 split.

- Trained a Random Forest Regressor as the predictive model.

- Evaluated the model on the test set using Mean Squared Error (MSE), achieving an MSE of 16.44, which translates to a Root Mean Squared Error (RMSE) of approximately $4.05.

Hyperparameter Tuning:

- Optimized the model by tuning key hyperparameters using RandomizedSearchCV to find the best configuration (e.g., number of trees, depth of trees, and minimum samples per split).

- Improved the model’s performance based on optimized parameters.

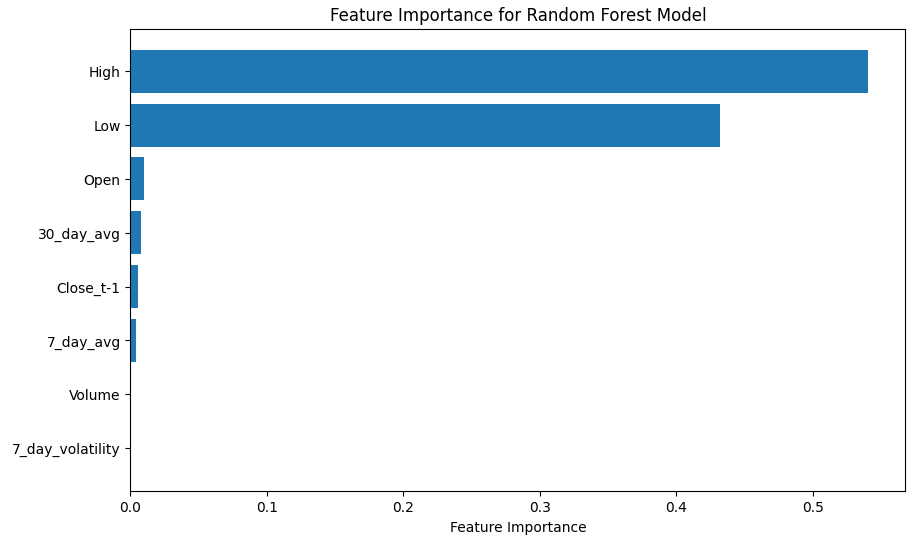

Feature Importance Analysis:

- Evaluated feature importance using the trained Random Forest model to understand which factors contributed most to predictions.

- Identified key features, such as previous day’s closing price (Close_t-1) and moving averages, as the most influential drivers of the model.

Model Visualization:

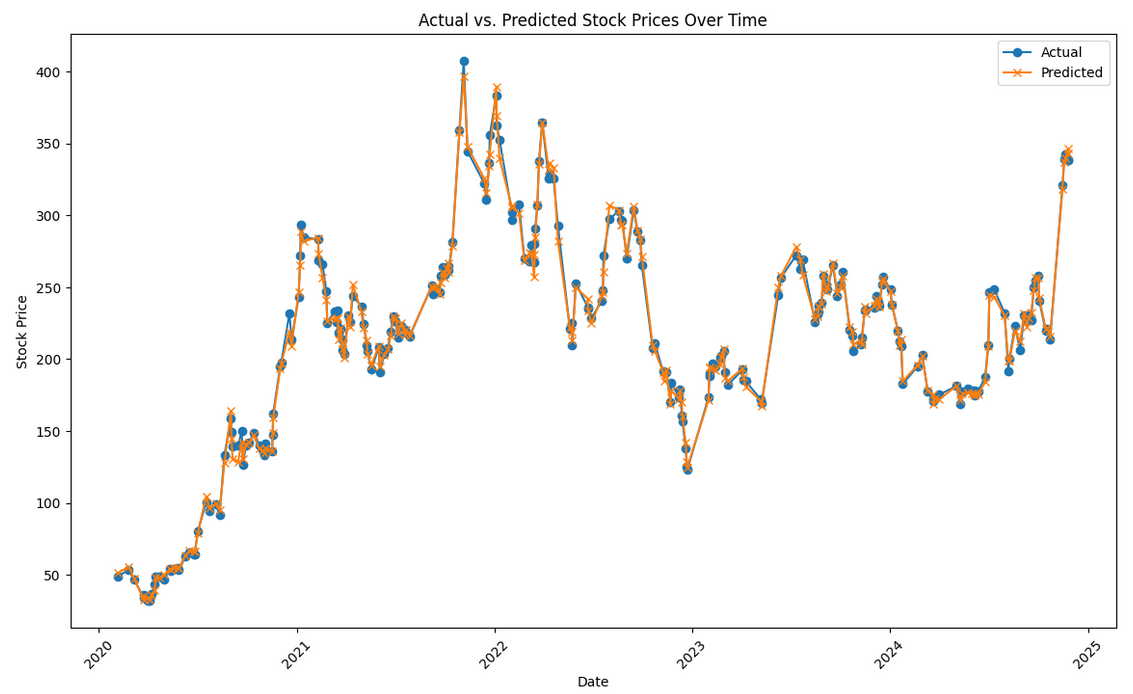

- Created visualizations to evaluate model performance: Actual vs. Predicted Stock Prices Over Time: Showed that the model accurately captures trends and movements in Tesla’s stock price.

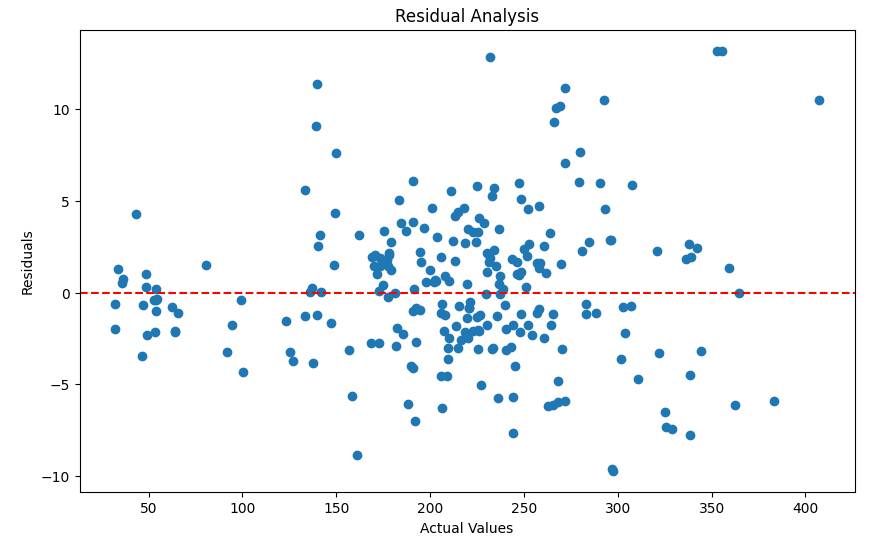

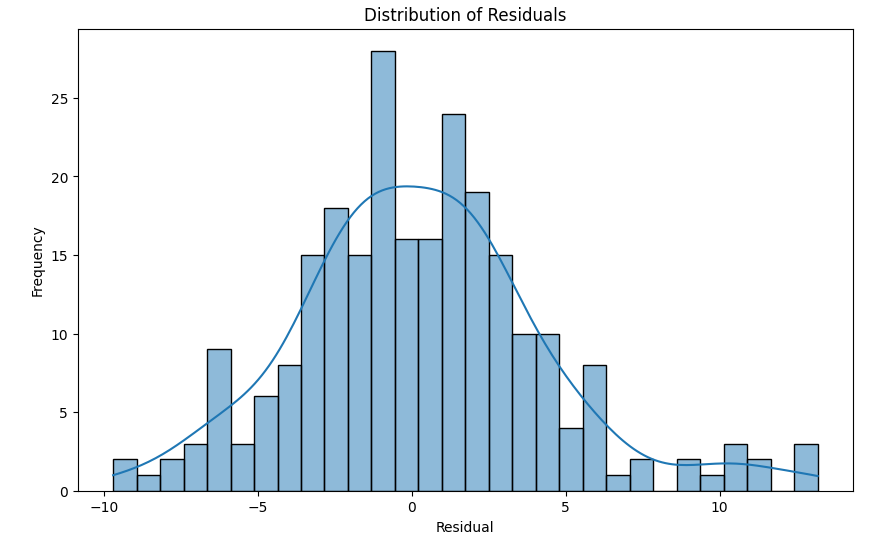

- Residual Plot: Confirmed that residuals were mostly randomly distributed around zero, indicating a lack of significant bias.

- Feature Importance Plot: Highlighted the relative importance of various features in predicting stock prices.

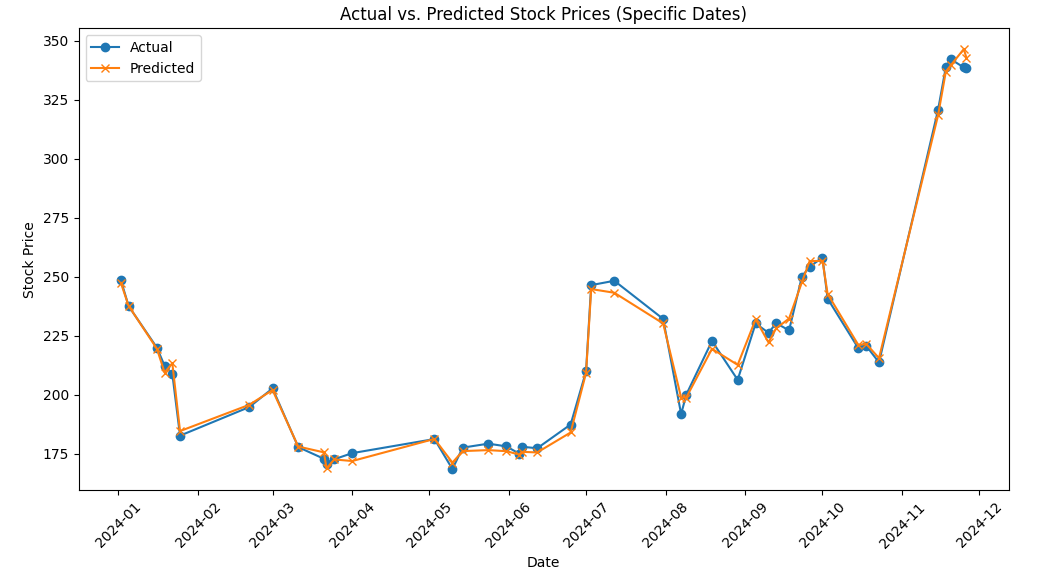

- Prediction for Future Dates: Used the trained model to predict Tesla's stock closing prices for specific future dates in this objective being December 31st 2024.ssary

Technologies Used

- Python

- Scikit-learn

- Pandas

- NumPy

Jupyter Notebook

Data Collection and Processing:

- Loaded historical Tesla stock price data.

- Preprocessed the data by cleaning columns (e.g., removing special characters like $) and converting them into numeric format.

- Checked for and handled missing values to ensure data integrity.

- Visualized historic data based on the values given

import pandas as pd

import matplotlib.pyplot as plt

# Load data

data = pd.read_csv('Tesla_StockPrice_Historical.csv')

# Convert date column to datetime

data['Date'] = pd.to_datetime(data['Date'])

# Sort data by date

data = data.sort_values('Date')

# Check for missing values

print(data.isnull().sum())

Output

Date 0

Close 0

Volume 0

Open 0

High 0

Low 0

dtype: int64

print(data.describe())

Output

Date Volume

count 1258 1.258000e+03

mean 2022-06-08 09:58:39.872814080 1.264734e+08

min 2019-12-09 00:00:00 2.940168e+07

25% 2021-03-10 06:00:00 7.611178e+07

50% 2022-06-07 12:00:00 1.030910e+08

75% 2023-09-07 18:00:00 1.469126e+08

max 2024-12-06 00:00:00 9.140809e+08

std NaN 8.239543e+07

#Format the Date to DateTime

data['Date'] = pd.to_datetime(data['Date'])

# Remove any symbols (like $ or commas) and convert to numeric

data['Close'] = data['Close'].replace('[\$,]', '', regex=True).astype(float)

plt.figure(figsize=(12, 6))

plt.plot(data['Date'], data['Close'], label='Close Price')

plt.title('Tesla Stock Closing Prices Over Time')

plt.xlabel('Date')

plt.ylabel('Close Price')

# Set y-axis limits

plt.ylim(data['Close'].min() * 0.9, data['Close'].max() * 1.1) # Adjust the range slightly

plt.legend()

plt.show()

Output

Model Training:

- Created lagging features (Close_t-1, Close_t-2, etc.), moving averages (e.g., 7_day_avg, 30_day_avg), and volatility metrics (e.g., 7_day_volatility) to capture trends and patterns in stock prices.

- Split the dataset into training and testing sets using by splitting.

- Trained a Random Forest Regressor as the predictive model.

- Evaluated the model on the test set using Mean Squared Error (MSE), achieving an MSE of 16.44, which translates to a Root Mean Squared Error (RMSE) of approximately $4.05.

#Addition of Lagging Features

#Add columns for previous days closing prices

data['Close_t-1'] = data['Close'].shift(1)

data['Close_t-2'] = data['Close'].shift(2)

#Calculate Moving Averages to Capture trends

data['7_day_avg'] = data['Close'].rolling(window=7).mean()

data['30_day_avg'] = data['Close'].rolling(window=30).mean()

#Measure Volatility (e.g standard deviation over 7 days)

data['7_day_volatility'] = data['Close'].rolling(window=7).std()

#Measure percent change to track momentum

data['pct_change'] = data['Close'].pct_change()

#Removal of missing values due to moving averages

data = data.dropna()

#Preparing the data for Modelling

#Define X and Y features

X = data[['Open', 'High', 'Low', 'Volume', 'Close_t-1', '7_day_avg', '30_day_avg', '7_day_volatility']]

y = data['Close']

#Train and Test Split

from sklearn.model_selection import train_test_split

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, shuffle=False)

print(X[['Open', 'High', 'Low']].head())

Output

Open High Low

1228 $38.13 $39.63 $37.27

1227 $37.62 $38.80 $37.04

1226 $38.04 $38.26 $36.95

1225 $36.13 $37.63 $35.95

1224 $37.90 $38.45 $37.21

# Remove symbols and convert to float

for col in ['Open', 'High', 'Low']:

X.loc[:, col] = X[col].replace('[\$,]', '', regex=True).astype(float)

#Check for Missing Values: After converting the columns check for any NaN values

print(X.isnull().sum())

Output

Open 0

High 0

Low 0

Volume 0

Close_t-1 0

7_day_avg 0

30_day_avg 0

7_day_volatility 0

dtype: int64

from sklearn.model_selection import train_test_split

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

from sklearn.ensemble import RandomForestRegressor

from sklearn.metrics import mean_squared_error

model = RandomForestRegressor(n_estimators=100, random_state=42)

model.fit(X_train, y_train)

y_pred = model.predict(X_test)

mse = mean_squared_error(y_test, y_pred)

print(f"Mean Squared Error: {mse}")

Output

Mean Squared Error: 16.441745205325304

MSE represents the average squared error between predicted and actual stock prices. In this case, it’s 16.44 (in squared units,dollars² for stock prices).

Example: Compare the RMSE to the range of the target variable (y). If Tesla’s stock prices range from, say, 300 to 500, then an error of $4.05 may be acceptable.

import matplotlib.pyplot as plt

residuals = y_test - y_pred

plt.figure(figsize=(10, 6))

plt.scatter(y_test, residuals)

plt.axhline(0, color='red', linestyle='--')

plt.xlabel("Actual Values")

plt.ylabel("Residuals")

plt.title("Residual Analysis")

plt.show()

Output�

Feature Importance Analysis

- Evaluated feature importance using the trained Random Forest model to understand which factors contributed most to predictions.

- Identified key features, such as previous day’s closing price (Close_t-1) and moving averages, as the most influential drivers of the model.

importances = model.feature_importances_

features = X.columns

sorted_indices = importances.argsort()

plt.figure(figsize=(10, 6))

plt.barh(features[sorted_indices], importances[sorted_indices])

plt.xlabel('Feature Importance')

plt.title('Feature Importance for Random Forest Model')

plt.show()

Output

# Example feature values for the final prediction

final_features = {

'Open': 400.0,

'High': 405.0,

'Low': 395.0,

'Volume': 1200000,

'Close_t-1': 398.0,

'7_day_avg': 399.5,

'30_day_avg': 396.0,

'7_day_volatility': 3.2,

'Date': '2024-12-31' # Add the date you wish to predict (datetime)

}

# Convert to a DataFrame

import pandas as pd

final_features_df = pd.DataFrame([final_features])

# Ensure the feature names match those used during training

final_features_df = final_features_df[model.feature_names_in_]

# Make the prediction

final_prediction = model.predict(final_features_df)

print(f"Predicted Closing Price on December 31, 2024: ${final_prediction[0]:.2f}")

Output

Predicted Closing Price on December 31, 2024: $394.25

# Add predictions to a DataFrame for visualization

test_results = X_test.copy()

test_results['Actual'] = y_test.values

test_results['Predicted'] = y_pred

test_results['Date'] = data.loc[y_test.index, 'Date'] # Ensure the Date column matches

# Sort by date for visualization

test_results = test_results.sort_values(by='Date')

# Plot

plt.figure(figsize=(14, 8))

plt.plot(test_results['Date'], test_results['Actual'], label='Actual', marker='o')

plt.plot(test_results['Date'], test_results['Predicted'], label='Predicted', marker='x')

plt.legend()

plt.title('Actual vs. Predicted Stock Prices Over Time')

plt.xlabel('Date')

plt.ylabel('Stock Price')

plt.xticks(rotation=45)

plt.show()

Output

import seaborn as sns

# Plot the distribution of residuals

plt.figure(figsize=(10, 6))

sns.histplot(residuals, kde=True, bins=30)

plt.title('Distribution of Residuals')

plt.xlabel('Residual')

plt.ylabel('Frequency')

plt.show()

Output

# Filter for specific dates

specific_dates = test_results[test_results['Date'].between('2024-01-01', '2024-12-31')]

# Plot

plt.figure(figsize=(12, 6))

plt.plot(specific_dates['Date'], specific_dates['Actual'], label='Actual', marker='o')

plt.plot(specific_dates['Date'], specific_dates['Predicted'], label='Predicted', marker='x')

plt.legend()

plt.title('Actual vs. Predicted Stock Prices (Specific Dates)')

plt.xlabel('Date')

plt.ylabel('Stock Price')

plt.xticks(rotation=45)

plt.show()

Output

On the base + sources:

Tesla Stock Price Prediction